“Kenapa rawatan kanser ni tak terus approve RM1 juta?”

Real case 1 :

Here’s the real claim record from my client’s ongoing cancer treatments.

So far, amount yang dah approved:

- Claim 1: RM55,726.56

- Claim 2: RM119,350.61

- Claim 3: RM147,305.42

Padahal dalam plan ni, annual limit RM1,000,000. So kenapa tak terus approve je semua amount tu sekali harung?

Sebab GL (Guarantee Letter) takkan approve lump sum terus sampai RM1 juta. GL approval ikut apa yang hospital apply, berdasarkan keperluan rawatan semasa. It’s a continuous process — dari satu fasa rawatan ke satu lagi — sampai la patient discharge.

Masa client ni tengah warded, dia selalu tanya:

“Will this treatment be covered?”

Jawapan I dari dulu sampai sekarang, sama je:

“Minta doktor apply dulu GL. Bila hospital submit, baru kita tahu boleh approve ke tak.”

Setiap kali ada treatment tambahan, I akan remind client untuk minta doktor dan hospital apply dulu GL.

Sebab GL ni actually between hospital and takaful operator. Agent macam I jadi orang tengah — kadang-kadang siap kena jadi Detective Conan. Contoh-contoh I jadi Detective Conan…

Real case 2 :

Ada satu client ni, policy dah more than 5 years. Tiba-tiba GL kena reject sebab “pre-existing condition”.

Padahal beberapa bulan sebelum tu, dia dah buat treatment untuk issue yang sama — takde masalah pun.

So I call CS, follow up sampai dapat the actual reason.

Rupanya hospital tersubmit sekali scan report 10 tahun lepas, for the same area. Tu yang system detect as pre-existing.

Lepas tahu, I terus explain kat client and guide dia untuk minta hospital rectify the issue.

Hospital je boleh fix benda ni sebab diorang yang handle medical part.

Nasib baik hospital tu cooperate — and GL pun akhirnya approved.

Sampai sekarang, that particular client masih lagi continue rawatan for that illness.

Real case 3 :

Story of another client from another state.

Lepas discharge, dia pelik sebab still kena bayar a portion of the hospital bill — even though initial GL and final GL dua-dua dah approved.

So hospital cakap, “You boleh check with your agent or with AiA.”

Of course, dia call I lah 😅

Lepas I dengar his story, I terus request:

📄 GL yang dah approve

📄 Itemised bill

📄 Discharge summary

Time to activate my investigator mode 🔍

Lepas go through all the documents, I found the issue.

GL yang hospital apply tu hanya untuk penyakit A — and yes, segala treatment + ubat for A tu memang covered. ✅

Tapi… dalam bill tu, I nampak ada treatment dan medication untuk penyakit B juga.

And the thing is, penyakit B tu was not the reason for his admission.

So takde GL untuk B, which means — the takaful tak cover that part.

So that’s why dia kena bayar sendiri. 😬

Lagi satu important small detail —

Dia kena caj satu botol penuh ubat untuk penyakit B.

So I told him, “Kalau hospital charge satu botol, make sure bawak balik satu botol.

Tapi kalau makan sikit je, better request hospital adjust charge ikut berapa biji je yang ambil.”

Kadang-kadang benda macam ni nampak remeh, tapi boleh naikkan bil banyak kalau tak alert.

Nasib baik dia contact I dulu — kalau tak, dia pun tak tahu kenapa kena bayar extra.

So reminder untuk korang:

✔️ Jangan assume semua benda covered walaupun GL approved

✔️ Semak itemised bill

✔️ Tanya je kalau ada anything tak pasti.

✔️ And kalau ada agent (me) yang boleh selidik untuk you — lagi bagus 😌

Content creator & Islamic financial planner who keeps things fun, relatable & practical. Juggling life, family & great deals—always with a smile!

And hey, if you ever want to chat about retirement savings or financial planning, just hit me up! Let’s chat! ☎️ 012 223 1623[WhatsApp link]

I’m so glad you enjoy my articles, photos, and videos! Let’s keep it respectful—please don’t copy, reproduce, or share them without my permission. If you’d like to use something, just send me a quick message. I’d be happy to chat!

Raya Dulu-Dulu with Avisena

There’s something so heartwarming about Raya open houses — and this year, Avisena’s Raya Dulu-Dulu celebration never fails to bring the kampung vibes to life in the most beautiful way.

Serlah Seri Diri dengan SAFI

Okay girls, you have to hear this—especially kalau you tengah belajar or plan nak sambung belajar.

Baru-baru ni Liya pergi SAFI roadshow “Serlah Seri Diri – Anugerah Dihayati” kat IOI City Mall (from 23 to 27 April 2025 tau!), and let me just say—everything was pink, fun, and totally my vibe! Tapi bukan itu je yang buat I excited… SAFI is giving away biasiswakepada 25 siswi bertuah! Bukan calang-calang, okay—setiap satu boleh cecah RM40,000! Total dana is RM1 juta babe! Serious best

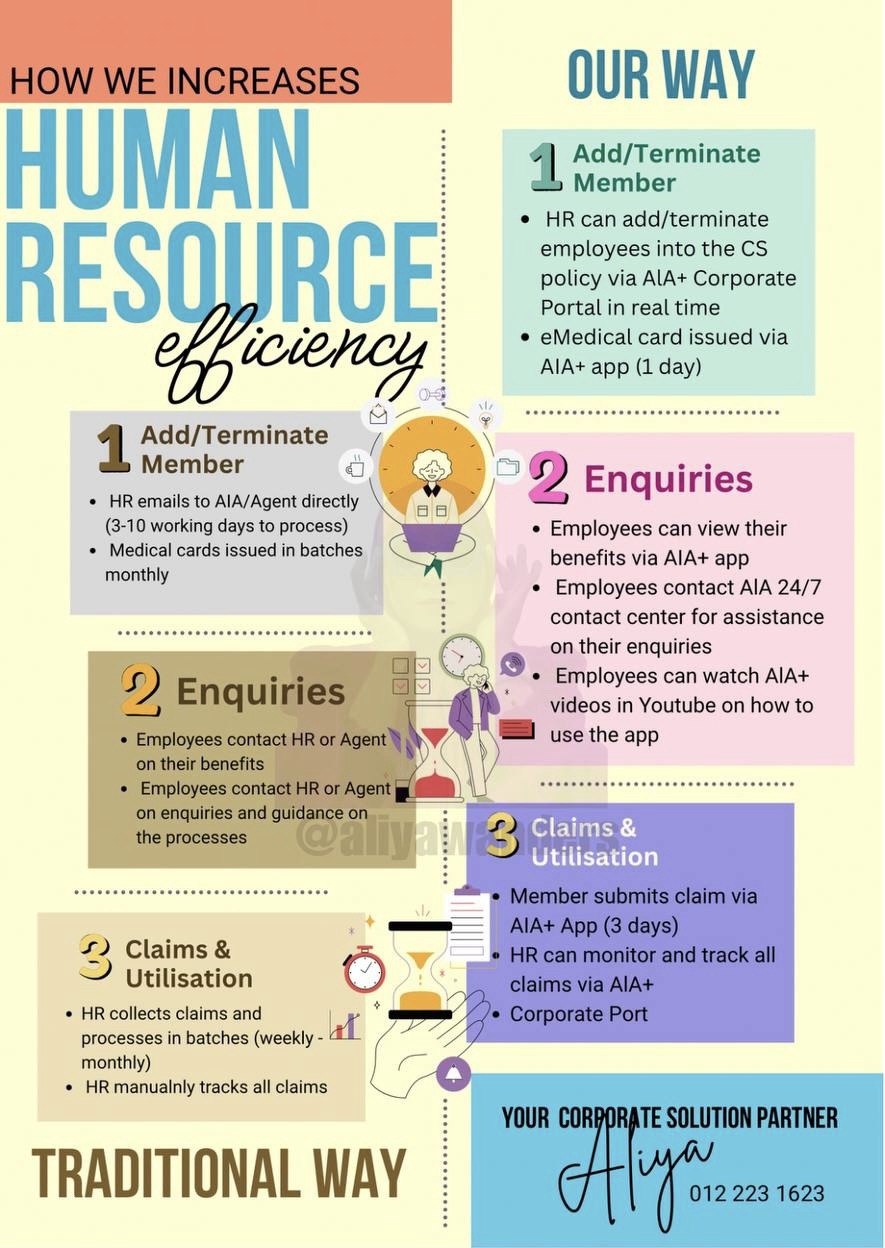

From Cost to Care: A Smarter Way to Manage Employee Medical Benefits

Hi, my name is Aliya and here’s why your company should consider getting corporate medical and health benefits with me and AIA Public Takaful.

Leave a comment