Estate planning sounds heavy and maybe even a bit intimidating. But if we strip away the big words and focus on what really matters, it’s just about making sure your loved ones are taken care of when you’re no longer around.

There are a few common tools people use to manage their estates, and I’ll walk you through them one by one. So grab your teh tarik (or coffee), and let’s go through these estate planning instruments the chill way. ☕✨

Before we delve further, hi, I’m Aliya — an Islamic Financial Planner passionate about helping Muslims manage their finances the halal way. Whether you’re planning for the future, protecting your assets, or learning how hibah works, I’m here to guide you with practical, faith-aligned solutions.

Got questions or need clarity? Just drop me a message — I’d love to connect. I could be contacted at +6012 – 223 1623 or http://askaliyahow.wasap.my/

- Wasiat (Islamic Will)

- Trust (Wisoyyah)

- Hibah (Gift During Lifetime)

- Power of Attorney (POA)

- Waqf (Charitable Endowment)

- Family Waqf (Waqf al-Ahli)

- Welfare Waqf (Waqf al-Khayri)

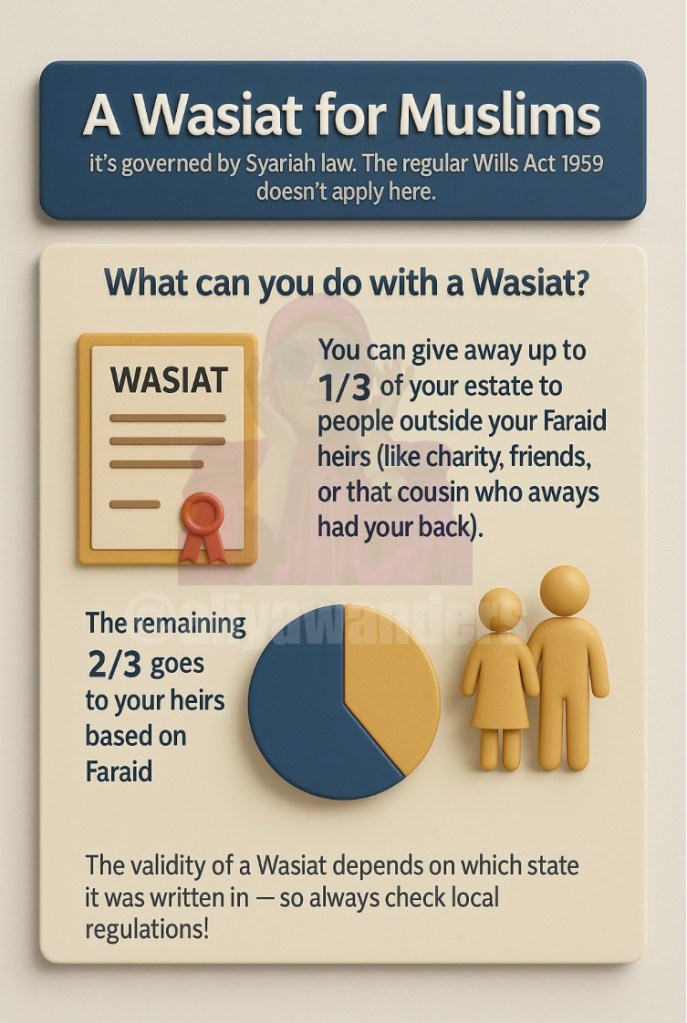

Wasiat (Islamic Will)

A Wasiat is kind of like a will — but for Muslims, it’s governed by Syariah law. The regular Wills Act 1959 doesn’t apply here.

What can you do with a Wasiat?

1. You can give away up to 1/3 of your estate to people outside your Faraid heirs (like charity, friends, or that cousin who always had your back).

2. The remaining 2/3 goes to your heirs based on Faraid (Islamic inheritance rules).

P/S: The validity of a Wasiat depends on which state it was written in — so always check local regulations!

Trust (Wisoyyah)

Think of Wisoyyah as appointing someone responsible (your Wasi, or Executor) to handle all your affairs when you’re gone.

Their job includes:

- Gathering all your assets

- Settling debts

- Executing your Wasiat and any unfulfilled hibah (gifts)

- Sorting out harta sepencarian (matrimonial property)

- Distributing everything to your rightful heirs

Basically, it’s your posthumous personal assistant.

Hibah (Gift During Lifetime)

Hibah can be translated simply as ‘gift. If a Muslim wishes to give away something they own, or any amount of money, to someone else (a person or organisation such as a charity) then they may do so by immediately transferring the legal title and possession of the gift itself to the recipient of the gift (known as the ‘donee’).

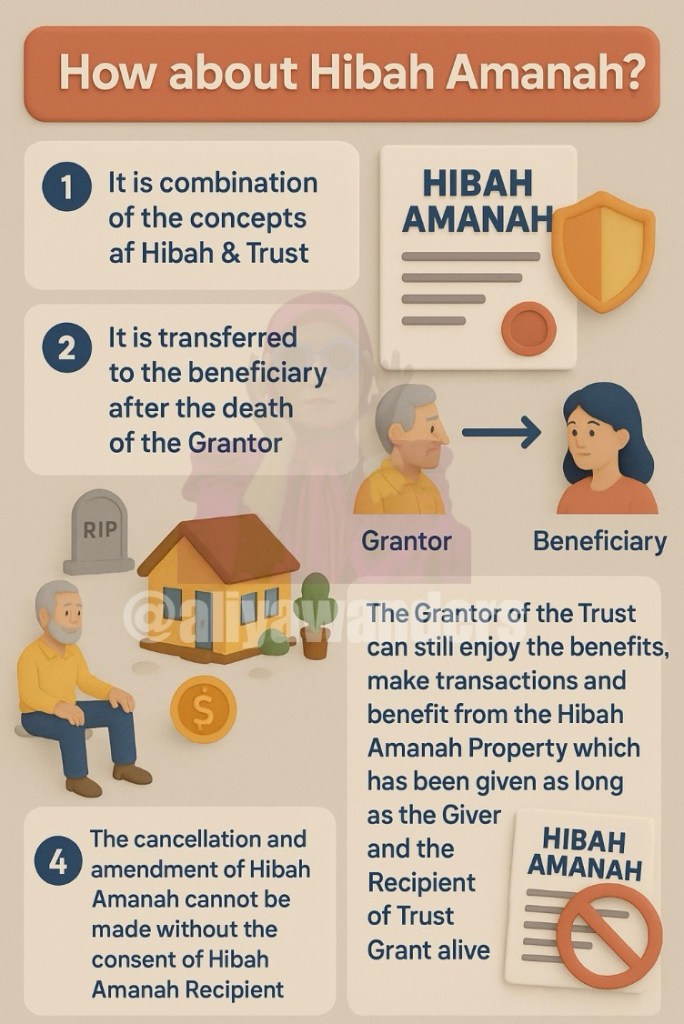

How about Hibah Amanah?

- It is combination of the concepts of Hibah & Trust.

- It is transferred to the beneficiary after the death of the Grantor.

- The Grantor of the Trust can still enjoy the benefits, make transactions and benefit from the

- Hibah Amanah Property which has been given as long as the Giver and the Recipient of the Trust Grant are alive.

Basically it’s a blend of Hibah and Trust — so you can enjoy the property while you’re alive, live in the house, use the land, or manage the business asset — as long as you’re alive.but it’ll go to the intended person after you pass away.

⚠️ However the cancellation and amendment of Hibah Amanah cannot be made without the consent of the Hibah Amanah Recipient unless the Recipient of Hibah Amanah is the biological child and/or biological grandson of the Trustee.

Power of Attorney (POA)

The POA will essentially give the person limited or full authority to make a decision on the said properties or assets. It lets you appoint someone to manage your affairs or assets (including properties) on your behalf — especially helpful if you’re abroad or unwell.

The principal remains the legal owner of the properties or assets and can typically limit, revoke, or change the POA as long as they are mentally competent.

Just remember:

It can be general or specific, valid in Peninsular Malaysia, certain Act not applicable in Sarawak & Sabah.

Waqf (Charitable Endowment)

Waqf is all about leaving behind a legacy. It’s when you dedicate property, land, or money to benefit others — forever.

Once something becomes Waqf, you can’t take it back. It’s no longer yours.

It’s for:

- Charity

- Community projects

- Religious

- Educational causes

Think mosques, schools, hospitals, or a water pump for a village.

Family Waqf (Waqf al-Ahli)

This one’s personal. You create it to support your family — like providing a home or basic needs for your children, spouse, or close relatives.

When your named family members pass on, the property will then go to public welfare. So your legacy helps both family and society.

Welfare Waqf (Waqf al-Khayri)

This is the Waqf that benefits everyone — the poor, orphans, people with disabilities, and the general public.

Examples include:

Building community halls, Mosques and madrasahs, Hospitals and graveyards.

It’s a beautiful way to leave a lasting impact on the world — even long after you’re gone.

Estate planning isn’t just for the rich or elderly. It’s for anyone who loves their family and wants to ease their burden during tough times. With the right tools — whether it’s a simple Wasiat or a Hibah Amanah — you’re setting the stage for peace of mind and clarity.

So, are you planning to write one soon? Or already have? Let’s chat — or maybe start drafting one over that second cup of coffee😉

Hey, lovely readers! Just a heads-up: some of the links in this blog are affiliate links. Don’t worry, clicking on them won’t cost you anything extra! But if you do make a purchase through them, I’ll earn a tiny commission, which helps keep my blog running. Thanks for the support!

I’m so glad you enjoy my articles, photos, and videos! Let’s keep it respectful—please don’t copy, reproduce, or share them without my permission. If you’d like to use something, just send me a quick message. I’d be happy to chat!

Start Your ASB Regular Saving

Enter ASB auto-debit, the life hack that takes the thinking (and temptation) out of saving. Just set it up once, and boom—your future self gets richer while your current self stays blissfully unaware. Let’s get to it.

Inside Malaysia’s New Entertainment Hotspot: Idea Live Arena at 3 Damansara!

If you’ve been craving bigger, better, and properlyset up indoor concerts, your wish just came true.

Idea Live Arena officially opened its doors at 3 Damansara, Petaling Jaya, and I had the chance to see it up close — and yes, it’s as good as everyone’s been hyping it up to be!

How to Start Saving in 3 Steps

So, you just got your first job—congrats! You’re finally earning your own money, maybe living on your own, and figuring out this whole adulting thing. You scroll through social media, and everyone’s talking about Takaful, savings, retirement plans… but hold up, do you really need to worry about all that now?

Leave a comment