Tag: Finance & Budgeting

-

Doing Hibah for Your Takaful Isn’t for You. It’s for the People You Love.

If You’re Earning an Income, You’re Already Insuring Your Family’s Life—But Have You Made It Official? Hi, I’m Aliya—an Islamic Financial Planner, and also a mom who understands the weight of responsibility that comes with being a breadwinner. Let’s have an honest chat today—just between us. If something happened to you tomorrow, would your loved…

Written by

·

-

Mind the Gap

When we talk about “protection,” most people immediately think of medical cards, insurance, or takaful. But here’s the thing — many Malaysians actually don’t have enough protection. This missing piece is what we call the protection gap. What is the Protection Gap? In simple words, the protection gap is the difference between what your family…

Written by

·

-

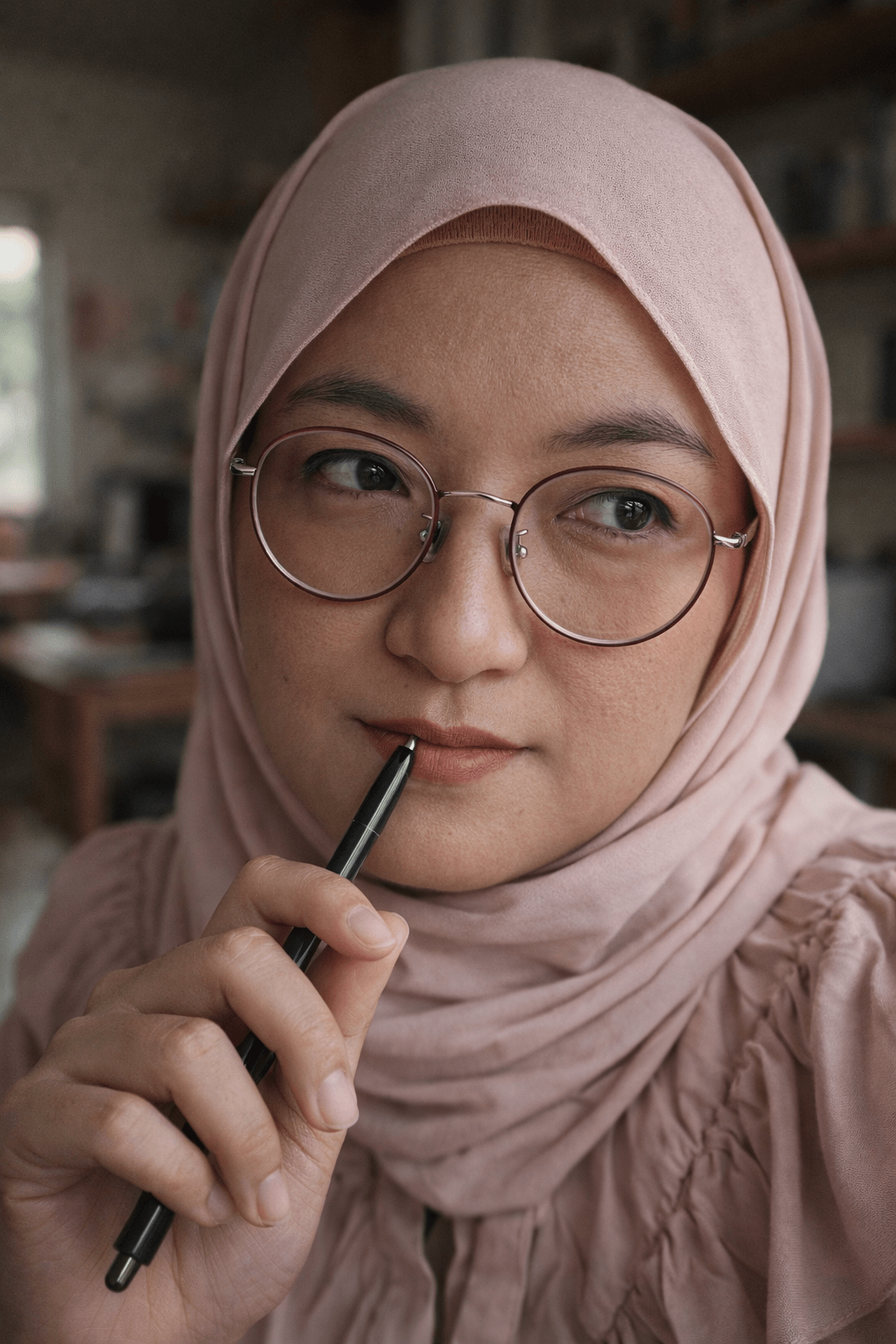

What You Need to Know About Death Claims

Let’s Talk Takaful Claims – Part 1: What You Need to Know About Death Claims Hi, I’m Aliya — your friendly neighbourhood Islamic Financial Planner. 😊 If we’ve met before, you’ll know I’m passionate about helping individuals and families make financial decisions that are both smart and aligned with our values. One question that always…

Written by

·

-

💔 “She Can Just Find Another Husband…”

I have a story to tell… When he was here, I never had to worry about bills, food, or our children’s future. Now, every ringgit counts. I stay up at night wondering how to keep a roof over our heads, how to pay for school, how to be strong when I feel completely lost. I’m…

Written by

·

-

Auto-Debit ASB: The “Set and Forget” Hack for Future You

Saving money manually is like convincing yourself to “start eating healthy on Monday.” You have the best intentions, but somehow, that nasi lemak still finds its way to your plate. Enter ASB auto-debit, the life hack that takes the thinking (and temptation) out of saving. Just set it up once, and boom—your future self gets…

Written by

·

-

How to Start Saving in 3 Steps

So, you just got your first job—congrats! You’re finally earning your own money, maybe living on your own, and figuring out this whole adulting thing. You scroll through social media, and everyone’s talking about Takaful, savings, retirement plans… but hold up, do you really need to worry about all that now? Or maybe you already…

Written by

·

-

Medical Card Is A Waste of Money?

Amir (real name hahaha) pays about RM100 for ASTRO bill every month without fail for the Sport’s package. RM100 gone each time. The thing is, we barely watches Astro. Almost ten years in, he suddenly feels like it’s a waste. “I’ve spent so much, but I barely watch the television. I always come home late,…

Written by

·

-

From Cost to Care: A Smarter Way to Manage Employee Medical Benefits

Hi, my name is Aliya and here’s why your company should consider getting corporate medical and health benefits with me and AIA Public Takaful. First things first – What’s Group Takaful? It’s a life/medical takaful certificate that covers a group of people (usually employees). The employer (you!) is the certificate owner, and the employees are…

Written by

·