This is Part 2

In Part 1, I shared an overview of the Private Retirement Scheme (PRS) and the basics you might want to know to get started.

Curious? Click here to read Part 1.

Imagine this: It’s the weekend, and you’re scrolling on your phone, dreaming of your future – maybe sipping coffee on a balcony overlooking the mountains or enjoying a peaceful retirement. But then the thought strikes – have I done enough to secure that dream? If you’re like me, you’ve probably wondered how to start planning for retirement, and that’s where the Private Retirement Scheme (PRS) comes in.

Let me make it simple for you. Setting up your PRS account on PPA PRS Online is a breeze, but I know some questions might be lingering in your mind. Let’s tackle them one by one:

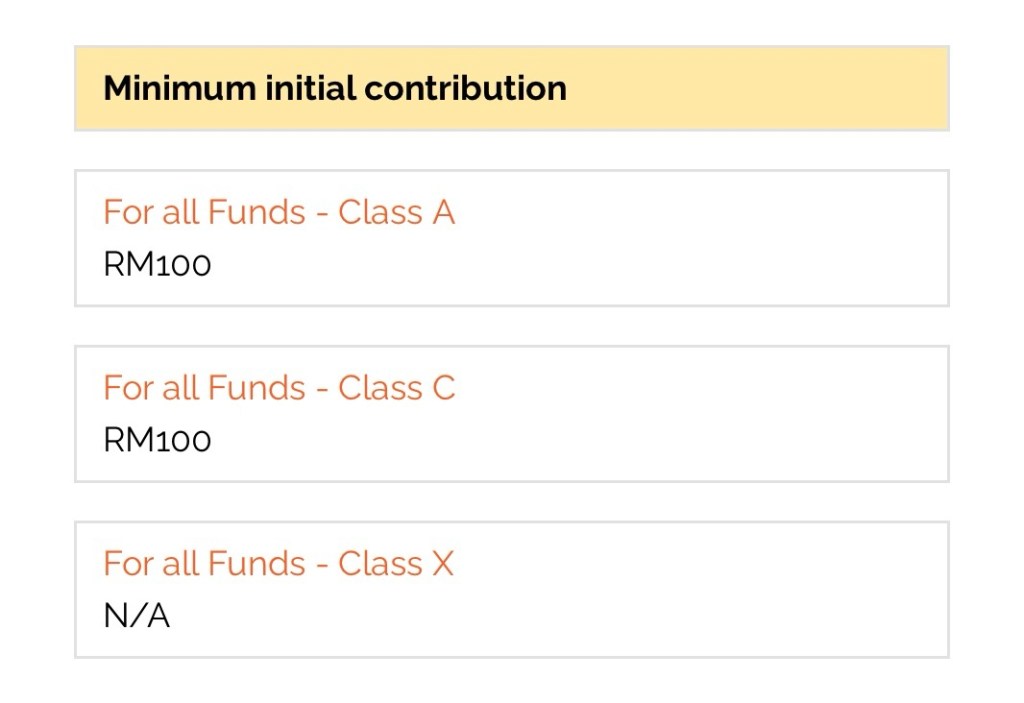

1. How much does it cost to open a PRS account?

Good news! The minimum contribution depends on the PRS provider. For instance, with Principal Asset Management Berhad, you can start with just RM100 for Class A funds (the only class currently available online). That’s like skipping a few fancy coffees to start building your retirement nest egg!

If you’d like to know more about Class C or Class X funds, I’m here to help. Reach out to me directly at +6012 223 1623 or tap this link to WhatsApp me: http://askaliyahow.wasap.my/.

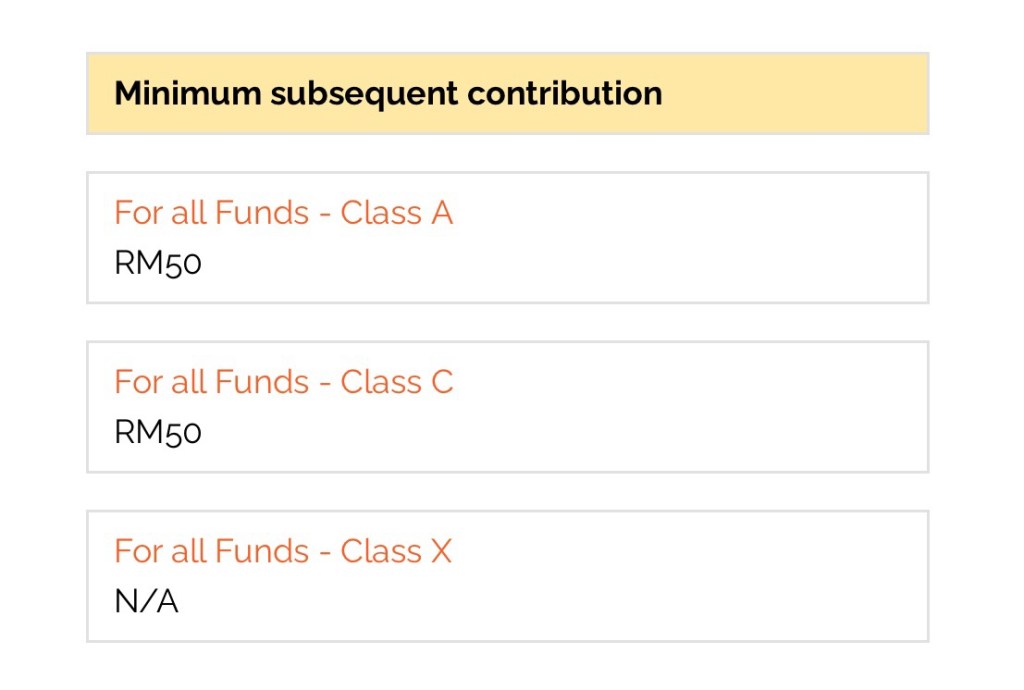

2. How much is the minimum top-up?

Easy-peasy. You can top up as little as RM50 for Class A and Class B funds. A small step today can lead to big rewards tomorrow.

3. How do I choose the right fund?

The PRS simplifies investing with its Do-It-For-Me (DIFM) also called Default Option, where your funds are automatically allocated based on your age group:

• Below 45 years: Focus on growth – a mix of risk and reward to outpace inflation.

• 45 to 54 years: A balanced approach – grow steadily while seeking income.

• 55 years and above: Prioritize income and capital preservation as you prepare for retirement.

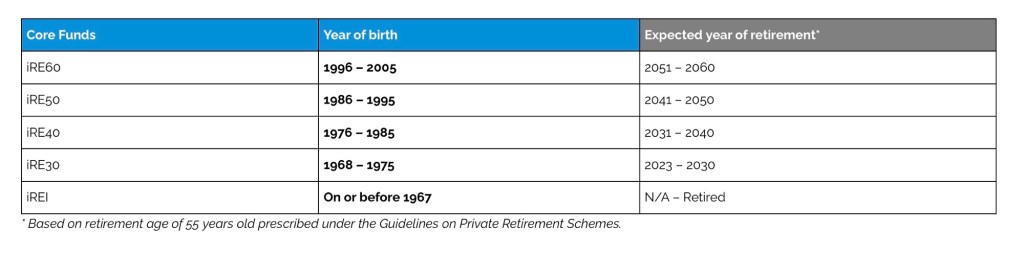

Default Option : Principal Asset Management Berhad has embarked on different default option schemes, check out the graphics below for a clearer understanding.

Overview of Target Date Fund (TDF)

A Target Date Fund (TDF), such as iRE60, iRE50, iRE40, or iRE30 in the table above, is an actively managed investment scheme designed to align with your retirement goals. Each TDF has a specific target year, indicated in the fund’s name (e.g., iRE60 is geared towards 2060).

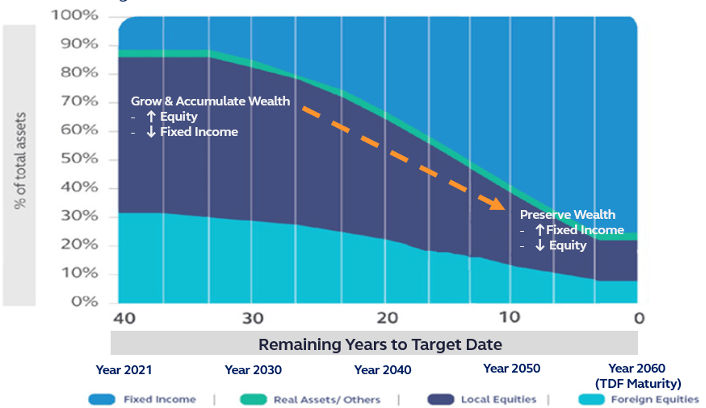

The TDF follows an asset allocation strategy tailored to the time remaining until its target date. As the target date approaches, the fund adjusts its investments, typically becoming more conservative to preserve capital. Once the target date is reached, the fund matures, ready for your retirement needs.

It’s a straightforward, hands-off approach for those planning for a specific retirement timeline!

Illustration of glide path.

Note: This is an illustration only and does not represent the actual asset allocation of any TDF at any point in time. The information on actual asset allocation for each TDF is available in the monthly fund fact sheet, which is available on Principal Malaysia website at www.principal.com.my.

Not ready to let someone else take the wheel? Opt for the Do-It-Myself (DIM) option and choose funds that match your risk appetite. The flexibility is all yours.

Real-Life Insights

From my experience, younger clients in their 20s and 30s are often open to taking higher risks for greater returns. By their late 40s, many shift to a balanced approach, preferring stability. However, I’ve even had clients in their 60s and 70s who are comfortable with higher-risk funds. Your choice depends entirely on your financial goals and comfort with market fluctuations.

Here’s the best part: If you’re under 30, you’ll enjoy 0% sales charges when signing up via PPA PRS Online. It’s the perfect opportunity to kick-start your retirement savings early and take advantage of compound growth.

Let’s Get You Started!

Retirement may seem far away, but the earlier you start, the bigger the payoff. Trust me, your future self will thank you for taking this step today. Ready to learn more? Stay tuned for Part 3, where I’ll dive deeper into fund classes (A, C, and X), other fees and many more.

Don’t wait for someday – start building your retirement dream today. If you’re curious or have questions, reach out! Together, we’ll make your retirement planning journey stress-free and rewarding.

If you found my article helpful, consider using my referral code 00015792 when subscribing to the Private Retirement Scheme (PRS). I’ll earn a small commission, which helps me keep this website running and continue sharing valuable insights. Thank you for your support!

Source :

Thank you for enjoying my articles, photos, and videos! I truly appreciate your support. To maintain the integrity of my work, please refrain from reproducing, copying, or sharing any of my content without my written consent. If you’d like to use something, feel free to reach out to me directly—I’m more than happy to discuss it with you. Let’s keep it professional and respectful.

Leave a reply to So, how do I open a Private Retirement Scheme account? – Aliyawanders Cancel reply