Got a claim to submit? No worries—let’s get this sorted in a few taps.

But before we proceed, there are two things I want to highlight…

First, got questions about your finances? I’m here to help! Feel free to call me at +60 12 223 1623 or drop a message on WhatsApp (click here). Let’s chat and navigate your financial journey together.

Secondly…

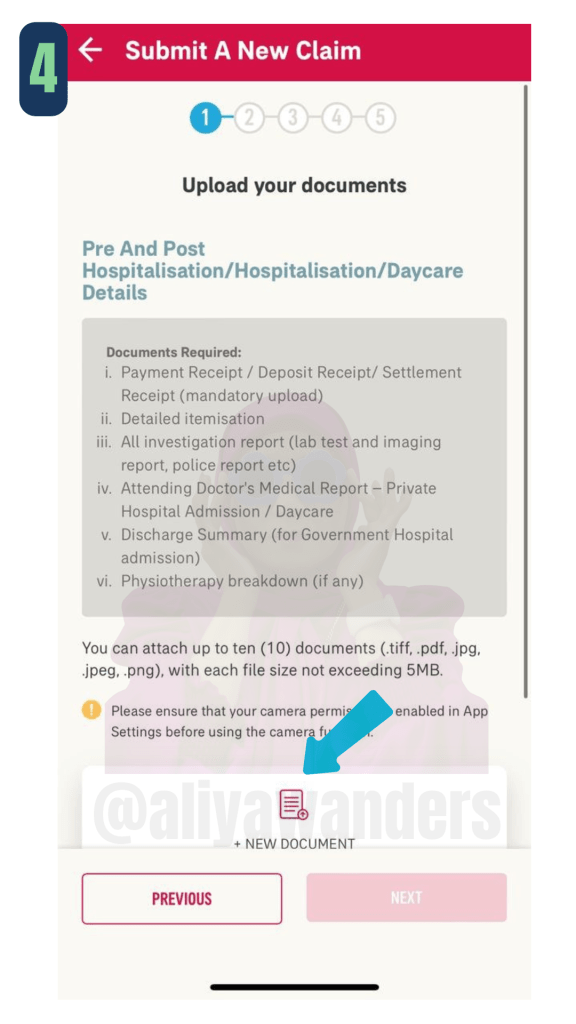

Documents You’ll Need for Your Claim (Pre & Post-Hospitalisation, Hospitalisation, or Daycare)

To make the claim process smoother, make sure you have these:

✅ Receipts – Payment, deposit, or settlement (must upload this!)

✅ Itemised Breakdown – So they know what was charged

✅ Investigation Reports – Lab tests, imaging reports, police reports (if relevant)

✅ Attending Doctor’s Medical Report – Private Hospital Admission / Daycare

✅ Admission/Discharge Summary – For government hospital stays

✅ Physiotherapy Breakdown – If you had physio sessions

Ok now you are ready to start!

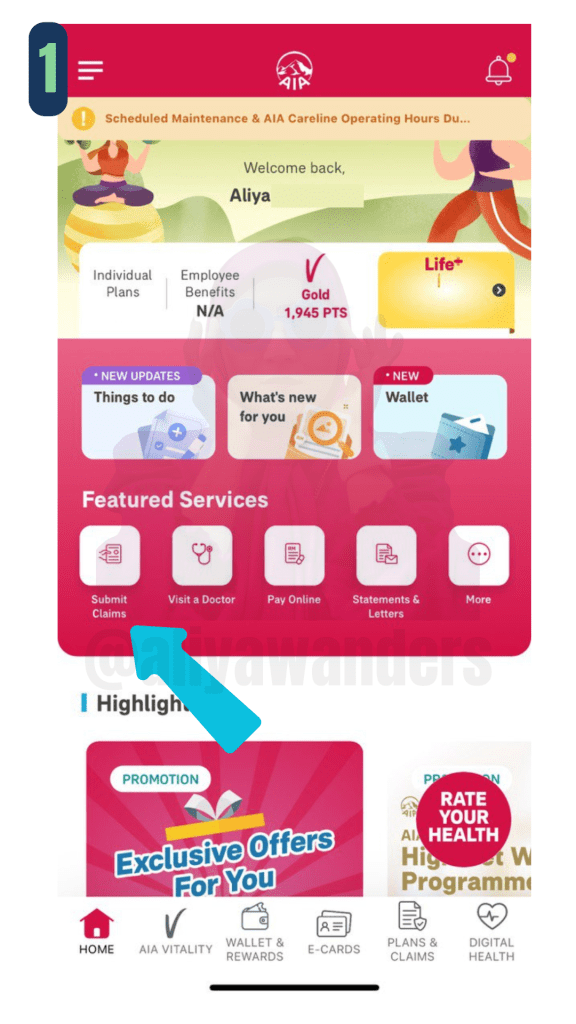

Step 1:

Fire up the AIA+ app, enter your details, and boom—you’re in.

Find ‘Submit Claim’ and tap it.

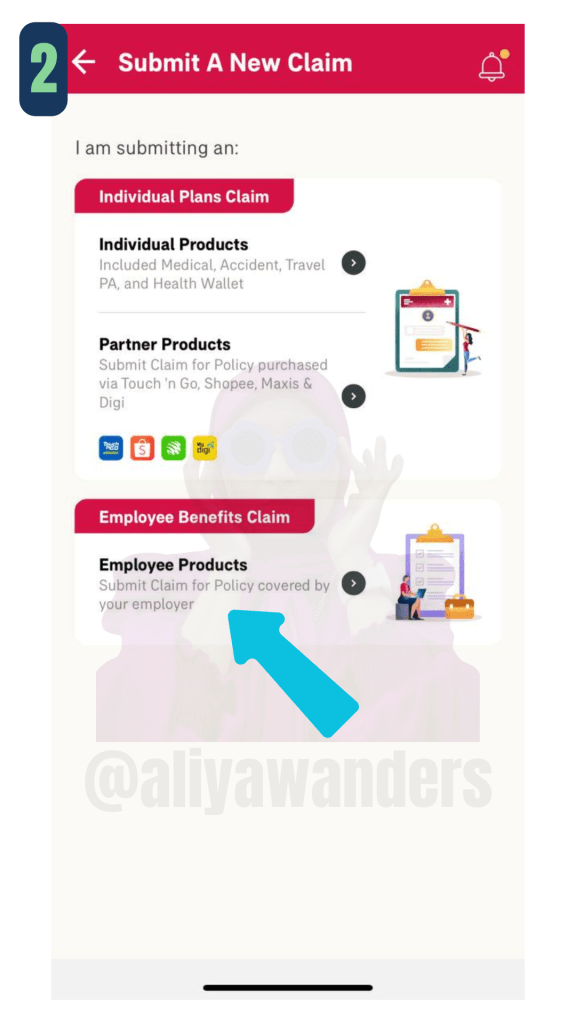

Step 2:

Find ‘Employee Products’ and tap this too…

Step 3:

Choose

- Date of Visit

- Claimant’s Name

- Claim Type

- Sub Claim Type

- Company Name

Click of the TnC and you are ready to click ‘Next’.

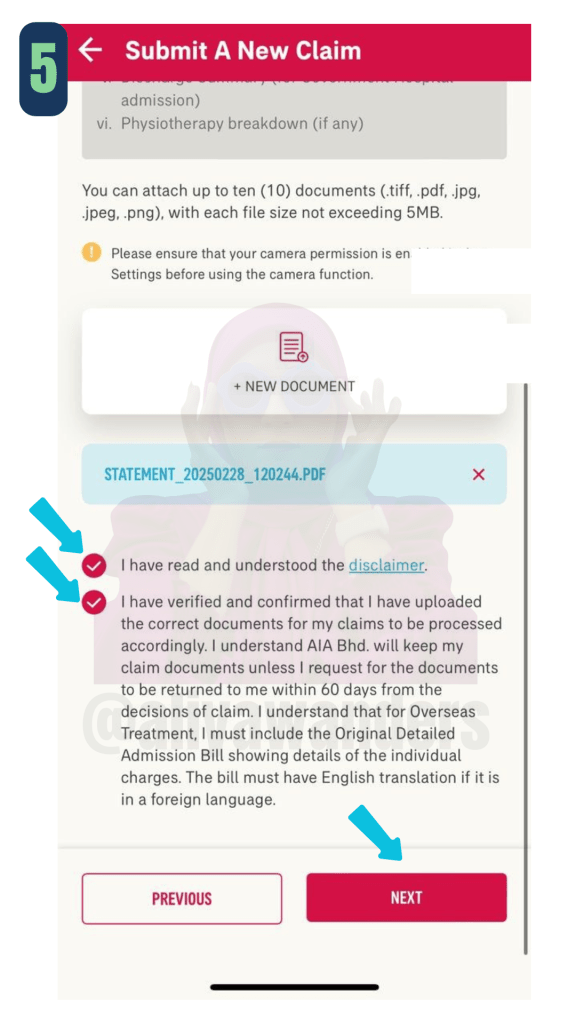

Step 5:

Show the receipts (literally).

Snap clear photos of your bills, reports, and any other proof.

You can upload up to 10 documents in these formats — .tiff, .pdf, .jpg, .jpeg & .png.

Step 6:

Double-check, then send it off.

Review everything, agree on the TnC and hit ‘Submit’.

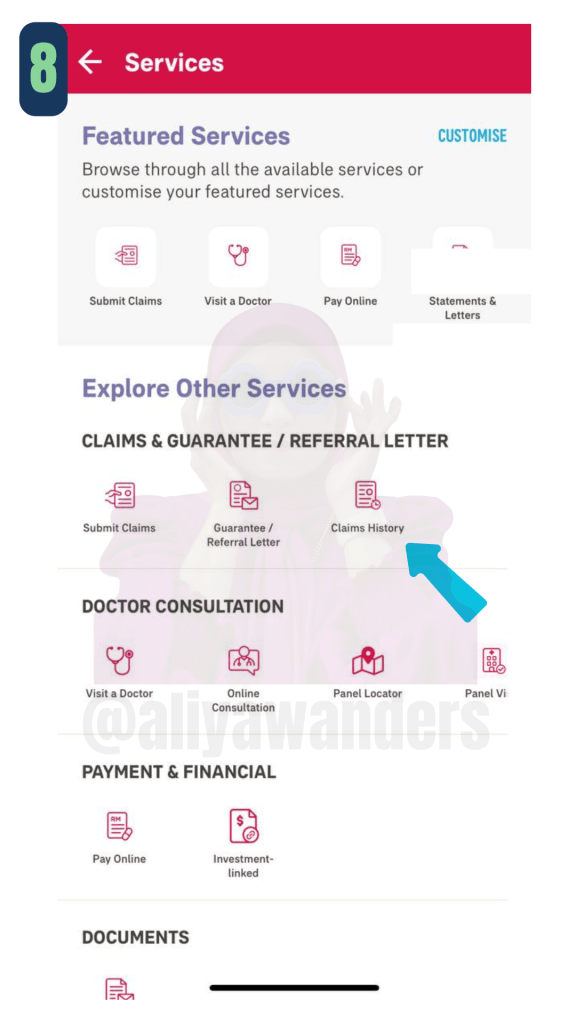

Head over to “Claims History” to track the progress.

And that’s it! Now sit back and wait for the reimbursement to happen.

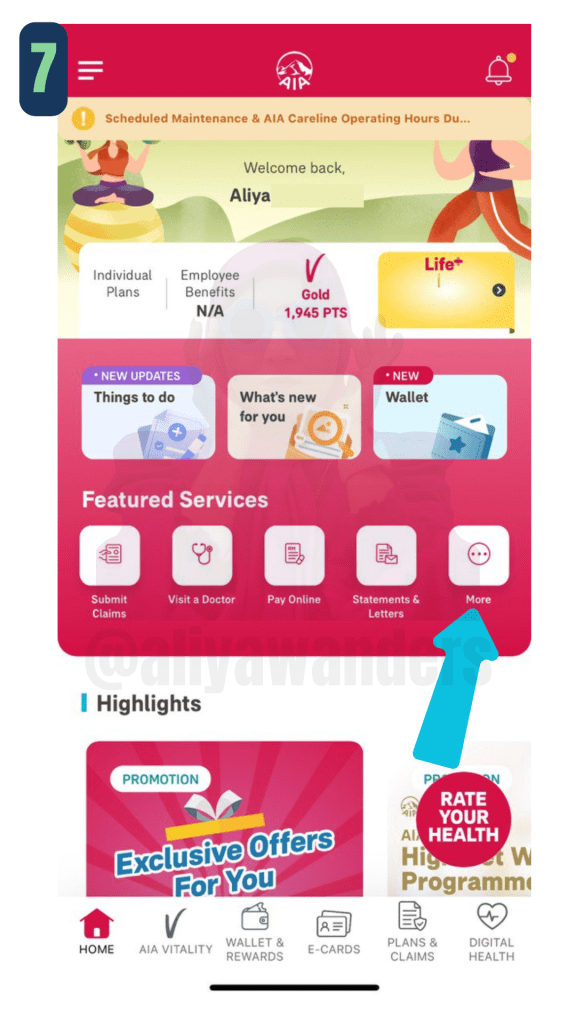

Step 7:

Where can I check for my ‘Claim History’ you ask?

Get back to the main page, and click ‘More’

Step 8:

There are more services you can explore on our cool app, but for now, click the ‘Claim History’

Hope this help.

Thank you for enjoying my articles, photos, and videos! I truly appreciate your support. To maintain the integrity of my work, please refrain from reproducing or copying my content without my written consent.

However you may share the link of any of my content. If you’d like to use something, feel free to reach out to me directly – I’m more than happy to discuss it with you. Let’s keep it professional and respectful.

Content creator & Islamic financial planner who keeps things fun, relatable & practical. Juggling life, family & great deals—always with a smile!

And hey, if you ever want to chat about retirement savings or financial planning, just hit me up! Let’s chat! ☎️ 012 223 1623 [WhatsApp link]

Switching Payment Methods Like a Pro on AIA+ App

Need to change your payment method? No problem! Just hop onto the AIA+ app and follow the steps to update your details.

A few taps, a quick confirmation, and boom—your new payment method is locked in. Just read on until the end and let me show you how.

Want to Create a RM1 Million Legacy for Your Children?

Our children deserve a head start in life.

I had a conversation with a client who has two kids. He told me he had already set aside RM1 million for each of them. That’s RM2 million in total! While that’s a solid plan, I asked him,

Are Unit Trusts Suitable for Emergency Funds? Let’s Break It Down.

Yesterday, I met a friend who’s going through a rough patch in her career – her future feels uncertain, and she’s understandably stressed. During our chat, she shared how a unit trust agent approached her at the café she is currently working at. The agent, initially pretending to need her mobile number for venue bookings, later tried to convince her to open an emergency fund using unit trust investments.

Leave a reply to From Cost to Care: A Smarter Way to Manage Employee Medical Benefits – Aliyawanders Cancel reply