So, you just got your first job—congrats! You’re finally earning your own money, maybe living on your own, and figuring out this whole adulting thing. You scroll through social media, and everyone’s talking about Takaful, savings, retirement plans… but hold up, do you really need to worry about all that now?

Or maybe you already want to start saving, maybe even sign up for Takaful, but let’s be real—cost of living is no joke. Can you even afford it?

Look, I get it. Saving sounds like one of those things you’ll “get to later.” But trust me, the earlier you start, the less painful it’ll be in the long run. After more than 20 years as unit trust agent. I’ve so many people who only started asking pasal retirement savings when they are have 10 years to go before retirement.

While I always believe, better to start late than never, starting late also means you have to put way more into your retirement savings on a much shorter timeline. And there is a possibility such an amount is out of your budget. In which case you will have to start reducing your lifestyle expenses.

So, here are some simple, no-BS tips to help you get started.

Step 1: Start Small. No, Even Smaller.

Yes, you read that right. Start with literally anything—RM0.50, RM1, RM10, RM100—whatever you can spare. The amount doesn’t matter. What matters is building the habit.

And guess what? You don’t even need to open a savings account yet. Just grab an empty jar and start dropping in coins or small bills. The only rule? Don’t touch it.

I’m sure we all have one of these in our kitchen. Even the biskut raya jars could work. No need anything fancy to start.

If you’ve never been the “saving type,” this is the easiest way to train yourself. Totally no excuses.

What matters most in the beginning is consistency and persistence in building the habit of setting some money aside.

Step 2: Once You’re Used to NOT Touching Your Savings, Plan Properly

Alright, so you’ve got your little “jar of discipline” going. Now, let’s level up.

Here’s a simple budget breakdown:

• 50% – Necessities (food, rent, bills, transport)

• 10% – Financial Freedom (Insurance/Takaful & Retirement Savings)

• 10% – Long-term savings & emergency fund

• 10% – Education (books, courses—invest in yourself!)

• 10% – Charity (give back in any way you can)

• 10% – Play money (yes, you still get to have fun)

But hey, this isn’t set in stone. If you’re living in KL and earning RM2,000, your rent alone might eat into that 55%. Adjust as needed! The key is to save something, no matter how small.

Step 3: Where to Put Your Savings (Besides That Jar in Your Room)

So, you’ve built the habit. Now, where do you actually keep your money?

1. Amanah Saham Bumiputera (ASB)

A solid option, especially for beginners. Fixed unit price, no crazy market fluctuations, and the dividend has been decent over the years. Plus, it doubles as an emergency fund since you can withdraw when needed. You can top up via MyASNB app or even through your bank app.

Want to know how ASB dividend is calculated? Click here!

2. Private Retirement Scheme (PRS)

Once you’re ready for a bit more risk (and possibly more returns), PRS is worth considering. You can start with as little as RM100 and top up whenever you like. If you can commit, set up an auto-debit (even RM50/month works) so you can take advantage of dollar-cost averaging. Just remember—unit prices fluctuate (like a unit trust), so patience is key.

(I’ve written a whole three-part guide on PRS—check it out if you want the full breakdown.)

Part 1—Private Retirement Scheme (PRS): What’s the Deal?

Part 2—Retirement Planning Made Simple: Your Guide to Private Retirement Schemes (PRS)

Part 3—So, how do I open a Private Retirement Scheme account?

And hey, if you ever want to chat about retirement savings or financial planning, just hit me up! Here’s my number +6012 223 1623 , and here’s a shortcut to my WhatsApp—let’s talk!

3. Unit Trust (For Those Who Can Handle the Ups & Downs)

I’ve personally been doing regular savings into unit trusts for 20 years—and let me tell you, some years were rough. Some years, I even had to watch my funds dip into the red. But it paid off in the long run. If you’ve got the patience for market swings and a long-term mindset, unit trust might be worth considering.

(If you need guidance, hit me up—I’ve been through it all. Click here to get to my WhatsApp)

4. E-Wallet & Banking Apps with 3%+ Returns

If you’re not ready for investments, just park your money somewhere that gives you better returns than a regular savings account. Some options:

• TNG Go+ – 3.52% p.a.

• MAE (Maybank Tabung Fund) – ~3% p.a.

• GXBank – ~3% p.a.

I have a full tutorial on how to start your own MAE Tabung fund here

It’s low effort, no risk, and your money is still accessible anytime. It’s a win-win guys.

Just Start. Seriously.

The biggest mistake? Thinking you need to have a lot of money to start saving. You don’t. Start small. Start today.

And remember, there’s no perfect way to do this. Find what works for you, adjust along the way, and most importantly—stick to it. Your future self will thank you.

Content creator & Islamic financial planner who keeps things fun, relatable & practical. Juggling life, family & great deals—always with a smile!

And hey, if you ever want to chat about retirement savings or financial planning, just hit me up! Let’s chat! ☎️ 012 223 1623[WhatsApp link]

Thank you for enjoying my articles, photos, and videos! I truly appreciate your support. To maintain the integrity of my work, please refrain from reproducing or copying my content without my written consent.

However you may share the link of any of my content. If you’d like to use something, feel free to reach out to me directly – I’m more than happy to discuss it with you. Let’s keep it professional and respectful.

Sales Scripts: The Art of Selling Without Sounding Like a Desperate Ex

Ah, sales—the magical dance of convincing someone that your product or service is worth their hard-earned money. But let’s be real. Nobody likes to be sold to. We’ve all had that one pushy salesperson who made us want to fake a phone call or suddenly remember an “urgent meeting.”

From Awkward Silence to Chatterbox

I wasn’t always this smooth with strangers, unless we have met each other a few times, and I feel comfortable with you.

Hobbitoon Village – A Shire-Inspired Park

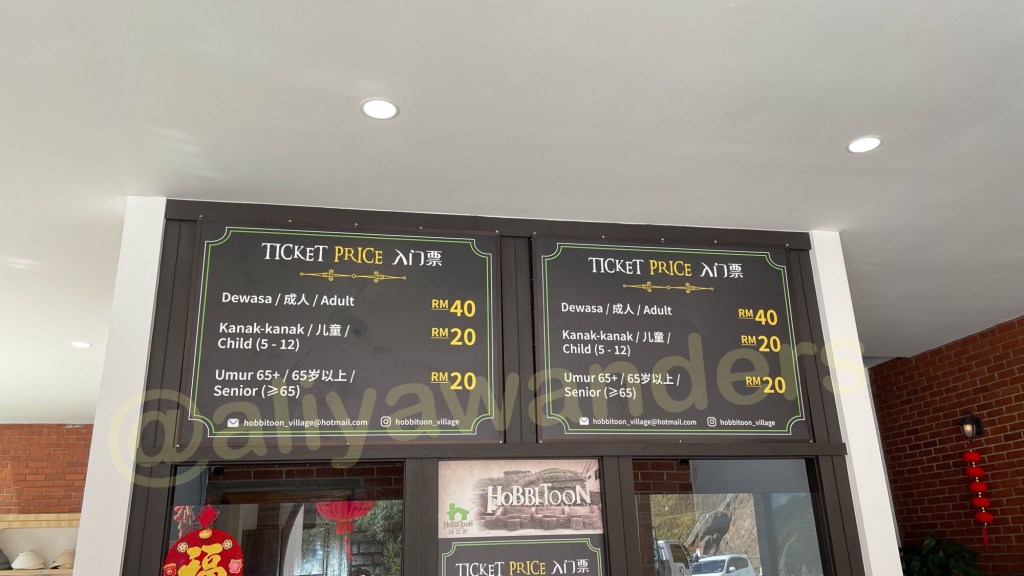

We left Shah Alam at 7:30 AM on a regular Tuesday morning and reached Hobbitoon Village in Simpang Pulai by 10:00 AM. Despite the heavy weekday morning traffic, the 2.5-hour drive was otherwise smooth, making this Hobbitoon Village very accessible. Hobbitoon Village nestled on 50 acres within a sprawling 300-acre plantation, surrounded by lush vegetation.

Leave a comment