Let’s Talk Takaful Claims – Part 1: What You Need to Know About Death Claims

Hi, I’m Aliya — your friendly neighbourhood Islamic Financial Planner. 😊

If we’ve met before, you’ll know I’m passionate about helping individuals and families make financial decisions that are both smart and aligned with our values. One question that always comes up in conversations is about takaful claims — especially when it comes to the “what now?” moments in life.

So if you’ve ever felt unsure or overwhelmed when thinking about how takaful claims work (or what documents are even needed!), I got you. Let’s break it down together, step by step — like a friend walking beside you through it all. ❤️

So, What Exactly Is a Takaful Claim?

In simple terms, a takaful claim is when someone requests compensation for a loss that’s covered under their takaful plan.

But here’s the real talk — submitting a claim, especially during emotional times like after a loss, can feel confusing and exhausting. It involves paperwork, procedures, and a whole lot of patience. That’s why I want to make this process easier for you to understand — and hopefully, a little less intimidating.

- So, What Exactly Is a Takaful Claim?

- 💡 In This Guide (Part 1), You’ll Learn:

- 💼 Which Takaful Plans Cover Death Claims?

- 📌 Step 1: Submitting the Claim Form to AIA

- 📂 Step 2: Claim Assessment by AIA

- How to Start Saving in 3 Steps

- Inside Malaysia’s New Entertainment Hotspot: Idea Live Arena at 3 Damansara!

- 1 Juta Annual Limit, Tapi Kenapa Tak Approve Semua?

💡 In This Guide (Part 1), You’ll Learn:

- The documents needed to submit a death claim

- Which plans offer this coverage

- What to expect during the claim process

This post focuses on death claims — and yes, it’s a heavy topic, but I promise to walk you through it gently. 💛

🌸 If You’ve Just Lost a Loved One…

First, I just want to say — I’m so sorry you’re going through this. Losing someone is never easy, and dealing with paperwork during a time of grief can feel like too much.

That’s why I’ve created this guide — so you (or your family members) have a clear list of what’s needed, without the added stress of figuring it out alone.

💼 Which Takaful Plans Cover Death Claims?

If you’ve signed up with me under any of these plans, you’ll be covered for death claims:

- A-Life Legasi

- A-Life Idaman

- A-Life Kasih Famili

- A-Plus ParentCare Xtra-i

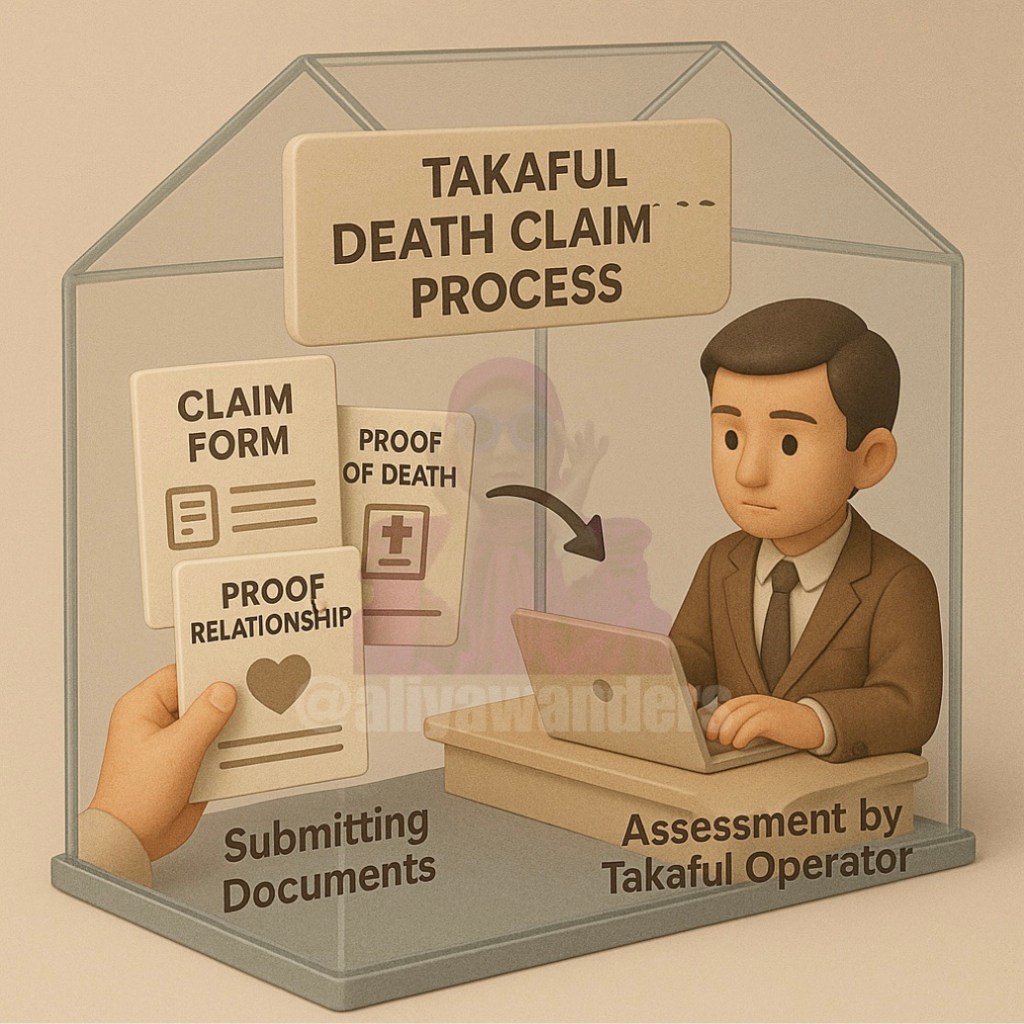

📌 Step 1: Submitting the Claim Form to AIA

First things first, you’ll need to gather all the required documents (listed below) and reach out to:

Your Life Planner/agent (that’s me!), or Visit any AIA Customer Centre

I’ll always help walk you through this part if you need it.

📝 Documents Required for Natural Death (Policy in force more than 24 months):

📝 Documents Required for Natural Death (Policy in force more than 24 months):

- Claimant’s Statement – Death Claim form

- Death Certificate of the Person Covered

- Proof of relationship (e.g. marriage or birth certificate)

- Certified NRIC/passport of the Claimant

- Grant of Probate (GP) or Letters of Administration (LA), if there’s no nomination

- Policy contract or Bond of Indemnity (with stamp duty)

🛑 Additional Documents for Accidental Death:

- Certified Police Report

- Certified Third Party Police Report (if available)

- Certified Post-mortem & Toxicology Report

- Certified Burial Permit Newspaper clipping (if available)

🕒 Additional Documents If Death Occurred Within 2 Years of Policy Issuance or Reinstatement:

- Attending Physician’s Statement(s)

- 5 copies of Consent Form & Patient’s Card

🌍 Additional Documents If Death Occurred Overseas:

- Certified JPN Letter Certified death certificate from the country of passing

💡 List is not exhaustive. Subject to benefit covered under the certificate.

📂 Step 2: Claim Assessment by AIA

Once all documents are submitted, AIA will start assessing the claim. You (or your family) can check on the progress through:

Your agent (again — me 😄) The AIA Care Line Or any AIA Customer Centre

💬 Got Questions?

If something’s still unclear, or if you’re wondering “Aliya, what happens if…” — drop your questions in the comments or DM me. I’ll try to include answers in Part 2, where we’ll cover on Total and Permanent Disability.

Remember, you don’t have to go through this alone. I’m here to make things a little clearer, a little easier — and to remind you that even in difficult times, you’re not alone. 💛

Content creator & Islamic financial planner who keeps things fun, relatable & practical. Juggling life, family & great deals—always with a smile!

And hey, if you ever want to chat about retirement savings or financial planning, just hit me up! Let’s chat! ☎️ 012 223 1623[WhatsApp link]

I’m so glad you enjoy my articles, photos, and videos! Let’s keep it respectful—please don’t copy, reproduce, or share them without my permission. If you’d like to use something, just send me a quick message. I’d be happy to chat!

How to Start Saving in 3 Steps

So, you just got your first job—congrats! You’re finally earning your own money, maybe living on your own, and figuring out this whole adulting thing. You scroll through social media, and everyone’s talking about Takaful, savings, retirement plans… but hold up, do you really need to worry about all that now?

Inside Malaysia’s New Entertainment Hotspot: Idea Live Arena at 3 Damansara!

If you’ve been craving bigger, better, and properlyset up indoor concerts, your wish just came true.

Idea Live Arena officially opened its doors at 3 Damansara, Petaling Jaya, and I had the chance to see it up close — and yes, it’s as good as everyone’s been hyping it up to be!

1 Juta Annual Limit, Tapi Kenapa Tak Approve Semua?

Padahal dalam plan ni, annual limit RM1,000,000. So kenapa tak terus approve je semua amount tu sekali harung?

Leave a comment