Category: Finance & Budgeting

-

Waiting Period Done… So Why Was His Certificate Cancelled?

A few years ago, I knew someone whose Takaful certificate was cancelled from inception. Waiting period? Completed. Contestability period? Completed too. So what went wrong?

Written by

·

-

Doing Hibah for Your Takaful Isn’t for You. It’s for the People You Love.

If You’re Earning an Income, You’re Already Insuring Your Family’s Life—But Have You Made It Official? Hi, I’m Aliya—an Islamic Financial Planner, and also a mom who understands the weight of responsibility that comes with being a breadwinner. Let’s have an honest chat today—just between us. If something happened to you tomorrow, would your loved…

Written by

·

-

Because Life Happens

As a financial planner — and also as a mom — I’ve seen how unexpected expenses can shake a family’s stability. Many people believe, “It’s okay, I can always rely on government hospitals if anything happens.” But here’s the truth: while treatment at government hospitals is subsidised, not all medications or procedures are fully covered.…

Written by

·

-

Mind the Gap

When we talk about “protection,” most people immediately think of medical cards, insurance, or takaful. But here’s the thing — many Malaysians actually don’t have enough protection. This missing piece is what we call the protection gap. What is the Protection Gap? In simple words, the protection gap is the difference between what your family…

Written by

·

-

How to Handle Sales Rejection Without Losing Your Sanity

Let’s be real—sales rejection sucks. You pour your heart into a pitch, get all hyped up, and then… bam—a big, fat NO. Sometimes they ghost you. Sometimes they say, “I’ll think about it” (spoiler: they won’t). And sometimes they shut you down so hard you start questioning all your life choices. But here’s the thing,…

Written by

·

-

💔 “She Can Just Find Another Husband…”

I have a story to tell… When he was here, I never had to worry about bills, food, or our children’s future. Now, every ringgit counts. I stay up at night wondering how to keep a roof over our heads, how to pay for school, how to be strong when I feel completely lost. I’m…

Written by

·

-

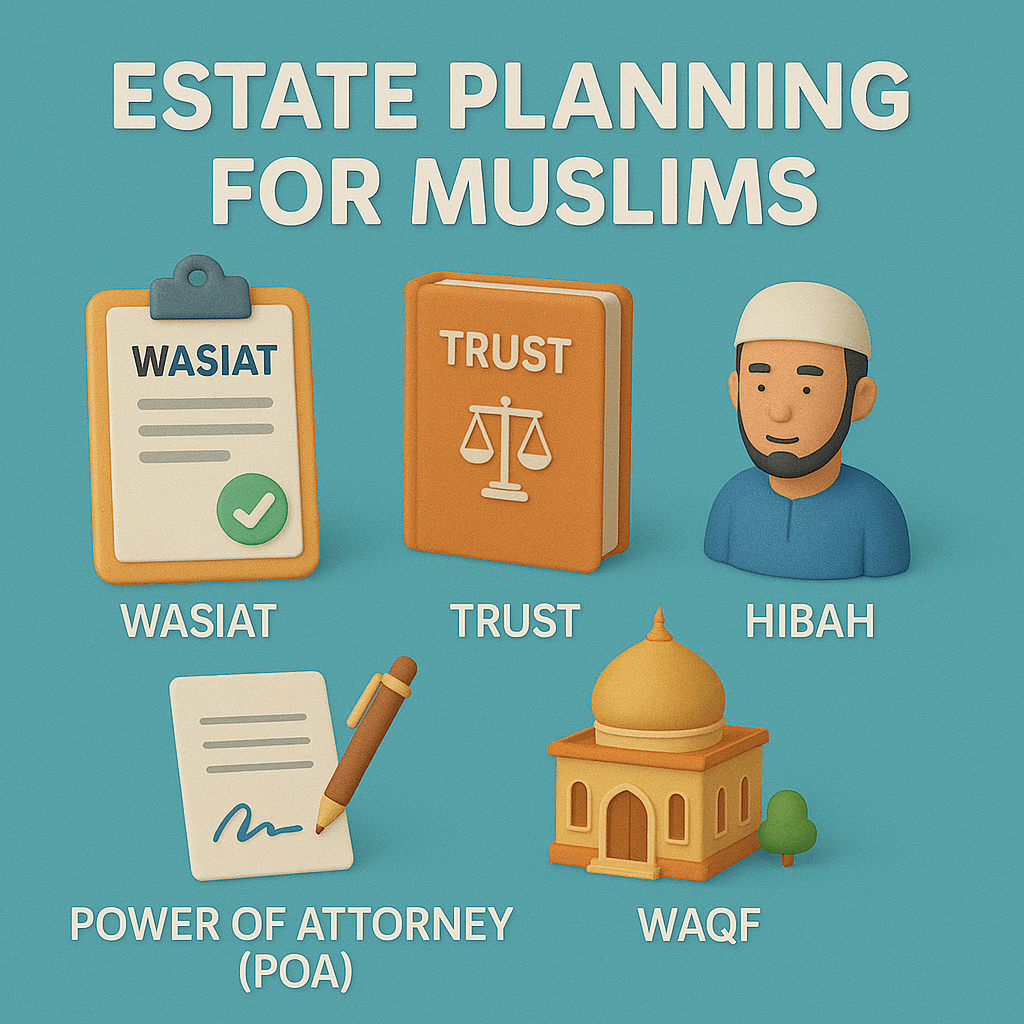

5 Must-Know Tools for Muslim Estate Planning

Estate planning sounds heavy and maybe even a bit intimidating. But if we strip away the big words and focus on what really matters, it’s just about making sure your loved ones are taken care of when you’re no longer around. There are a few common tools people use to manage their estates, and I’ll…

Written by

·

-

Auto-Debit ASB: The “Set and Forget” Hack for Future You

Saving money manually is like convincing yourself to “start eating healthy on Monday.” You have the best intentions, but somehow, that nasi lemak still finds its way to your plate. Enter ASB auto-debit, the life hack that takes the thinking (and temptation) out of saving. Just set it up once, and boom—your future self gets…

Written by

·

-

1 Juta Annual Limit, Tapi Kenapa Tak Approve Semua?

“Kenapa rawatan kanser ni tak terus approve RM1 juta?” Real case 1 : Padahal dalam plan ni, annual limit RM1,000,000. So kenapa tak terus approve je semua amount tu sekali harung? Sebab GL (Guarantee Letter) takkan approve lump sum terus sampai RM1 juta. GL approval ikut apa yang hospital apply, berdasarkan keperluan rawatan semasa. It’s…

Written by

·