ASB (Direct Investment)

The dividend for Amanah Saham Bumiputera (ASB) is calculated monthly on a prorated basis based on the minimum or available balance in the account.

When I asked the bank officer (when doing top up over the counter), this is what I was told.

1. Minimum Monthly Balance:

• ASB calculates the dividend based on the lowest account balance for each month.

• This ensures that any deposits made during the month won’t count toward that month’s dividend.

2. Monthly Proration:

• The dividend rate is applied monthly rather than averaged for the entire year.

• This means if the annual dividend rate is 5%, the prorated rate for each month would be approximately 5% ÷ 12 = 0.4167% per month.

3. Final Calculation:

• ASB adds up the monthly prorated dividends for the entire year to determine your total annual dividend payout.

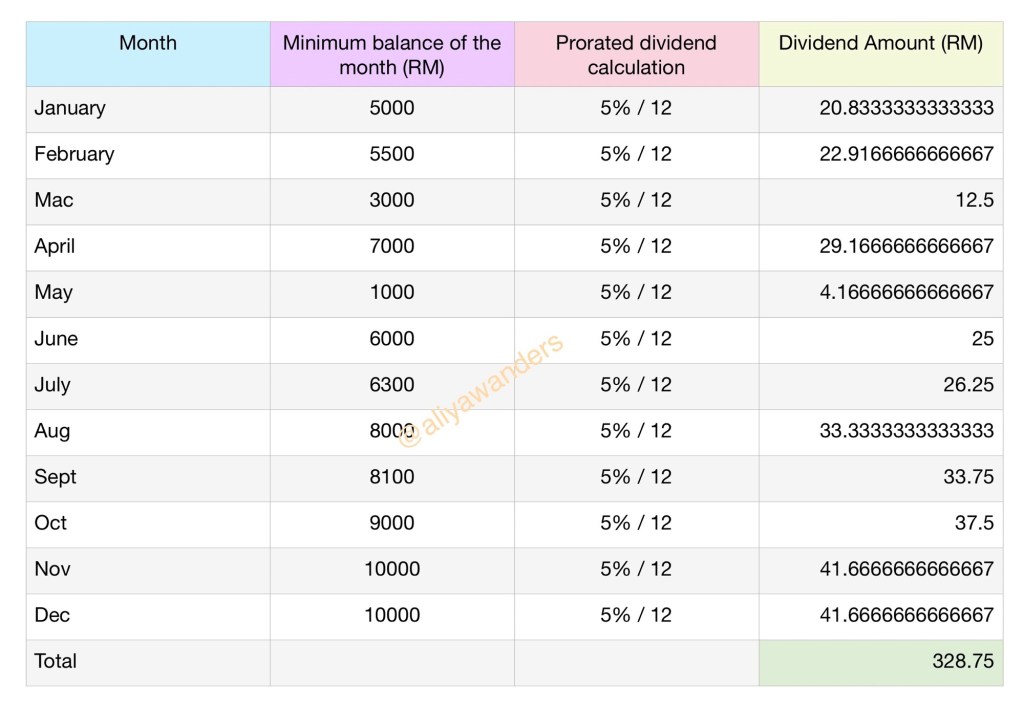

Example of Monthly Proration As Explained By the Banker:

If the declared dividend rate for the year is 5% :

However, when browsing on MyAsnb website

This is what I found :

But in the end, this still encourages consistent savings while not rewarding short-term deposits at the end of the year.

ASB Financing (Loan)

ASB Financing or ASBF is a loan facility provided by financial institutions to help you purchase ASB units.

The dividend calculation for ASBF is similar to investing directly in ASB, as dividends are calculated monthly on a prorated basis based on the minimum or available balance in the account. However, since you’re using a financing facility, the entire loan amount will be used for dividend calculations.

For instance, if your loan is approved in December 2023 and the full loan amount of RM100,000 is deposited into your ASB account in the same month, your ASB dividend calculation for 2024 will start in January with a minimum balance of RM100,000.

When you apply for ASB Financing, the principal loan amount cannot be withdrawn, ensuring that your ASB account always has at least RM100,000 as the minimum balance.

Example:

If the declared dividend rate for the year is 5%, your dividend calculation would be:

• RM100,000 x 5% = RM5,000

This amount will be credited to your ASB account.

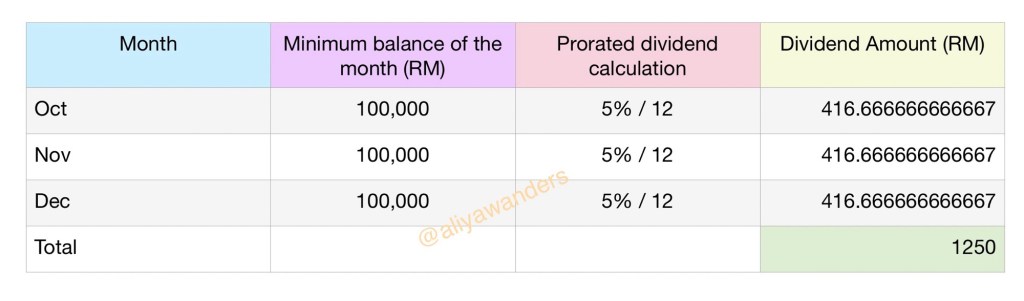

However, if the financing is only approved in September 2024 and the full loan amount of RM100,000 is deposited into your ASB account in the same month, your ASB dividend calculation for 2024 will begin in October with a minimum balance of RM100,000. This means you will receive a prorated dividend based on the remaining months of the year.

Example of Calculation Based On the Information from the Banker

If the declared dividend rate for the year is 5% :

However, I’m not able to provide example based on the formula shown on MyAsnb website. As I’m not sure will the total balance for 3 months (Oct, Nov, Dec) be divided by 12 or by 3.

It is important to note that your returns from ASBF will depend on the loan’s profit rate. If the profit rate is higher than the dividend yield, your effective gain may be reduced.

Example: If the financing profit rate is 4% and the dividend yield is 5%, your net gain would be approximately 1%.

While ASB is managed by Permodalan Nasional Berhad (PNB) and has a strong track record of providing consistent and competitive dividends, the dividend rates are not fixed or guaranteed. They are declared annually based on the fund’s performance and prevailing market conditions.

The dividend from ASBF is deposited directly into your ASB account. To maximize returns, it is crucial to be disciplined and let the dividend remain in your ASB account, allowing you to earn compounded dividends over the years.

Alternatively, if financially feasible, you can use the dividend to help repay your ASBF loan. However, depending on the dividend declared for the year and the loan’s profit rate, you may need to top up the amount to meet the full repayment.

Hope this help ☺️

Thank you for enjoying my articles, photos, and videos! I truly appreciate your support. To maintain the integrity of my work, please refrain from reproducing or copying my content without my written consent.

However you may share the link of any of my content. If you’d like to use something, feel free to reach out to me directly – I’m more than happy to discuss it with you. Let’s keep it professional and respectful.

Harta Sepencarian: Protecting What’s Yours Without the Drama

Ever wondered what happens to your property when you’re no longer around? No, this isn’t the plot of a 7pm drama, but if you’re married, Harta Sepencarian (matrimonial property) is something you should pay attention to. Let’s get deeper – before your future becomes an episode of Family Feud: Syariah Court Edition.

Want to Create a RM1 Million Legacy for Your Children?

I had a conversation with a client who has two kids. He told me he had already set aside RM1 million for each of them. That’s RM2 million in total! While that’s a solid plan, I asked him,

“Why not put aside just a portion of that money and let Takaful do the heavy lifting?”

Private Retirement Scheme (PRS): What’s the Deal?

I’ve been a PRS agent since the early days back in 2012 so let me share what I’ve learned about PRS over the years—and more importantly, how it can work for you.

Have you ever thought about how much you’ll need for retirement but felt like it’s a problem for “future you”? Well, let me tell you—future you is counting on present you to make some smart moves. And guess what? The Private Retirement Scheme (PRS) might just be the lifeline your retirement savings need.

Attention Content Creators: Unpaid Collabs Could Be Costlier Than You Think!

Recently, I came across an unpaid collaboration offering only food vouchers. But here’s the catch: they required a TIN (Taxpayer Identification Number) for e-invoicing. This raised a red flag. Could this mean even unpaid collaborations—where we receive products or vouchers—are taxable?

The answer isn’t great news for us creators. In Malaysia, any benefit received in kind, such as food vouchers or merchandise, is considered taxable income. This includes collaborations where no monetary payment is involved.

Leave a reply to How to Start Saving in 3 Steps – Aliyawanders Cancel reply