So, you’ve read Part 1 and Part 2 of my Private Retirement Scheme series, and now you’re ready to start. What’s next?

First things first—head over to ppa.my for self-registration. Isn’t it great that we can do this online now?”

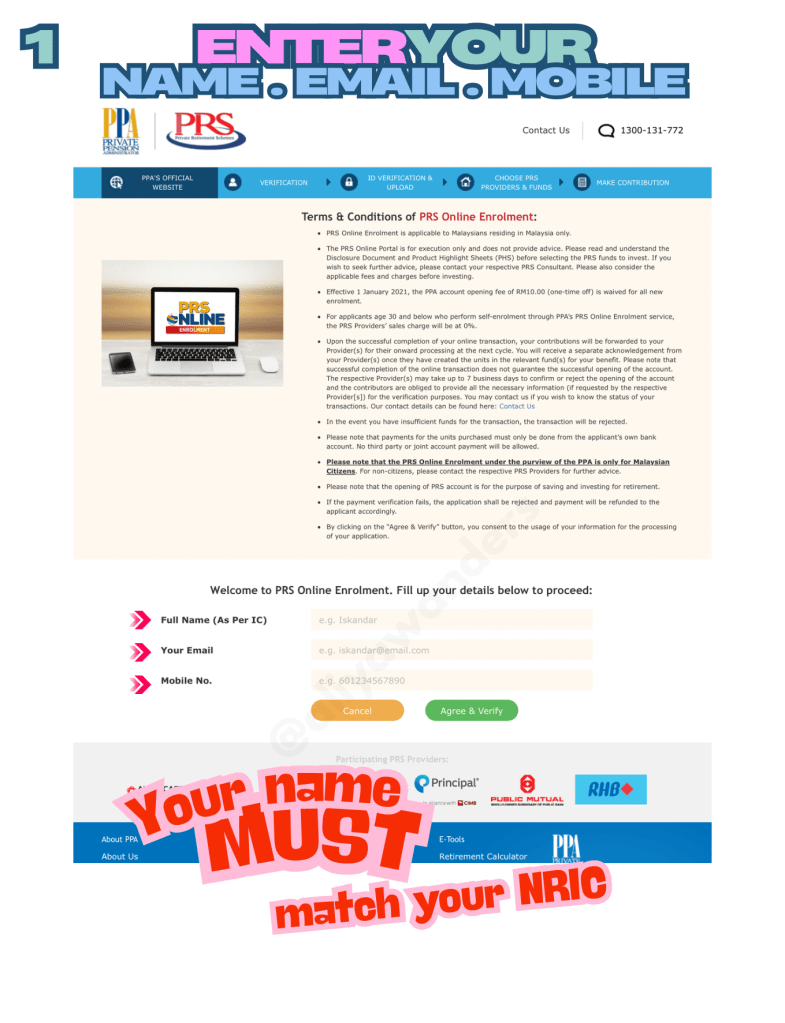

1. You’ll then be directed to this page. Enter your name, email, and mobile number. Make sure your name matches the one on your NRIC exactly.

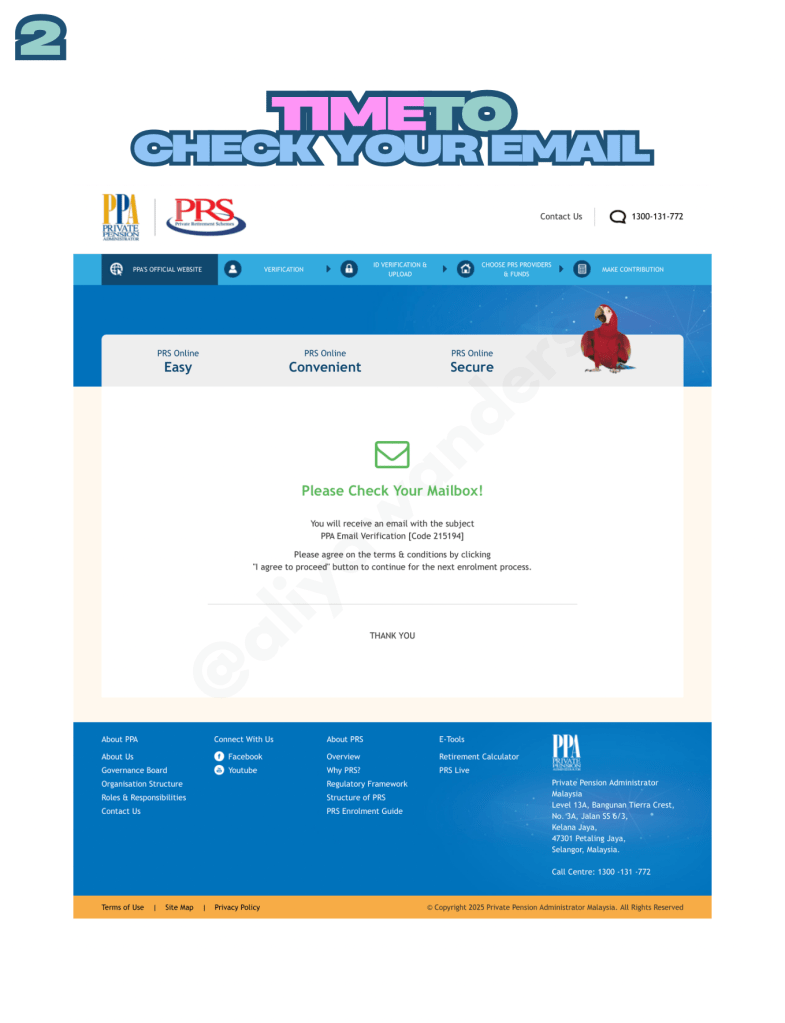

2. Now it’s time to check your email—click the link inside to verify your account.

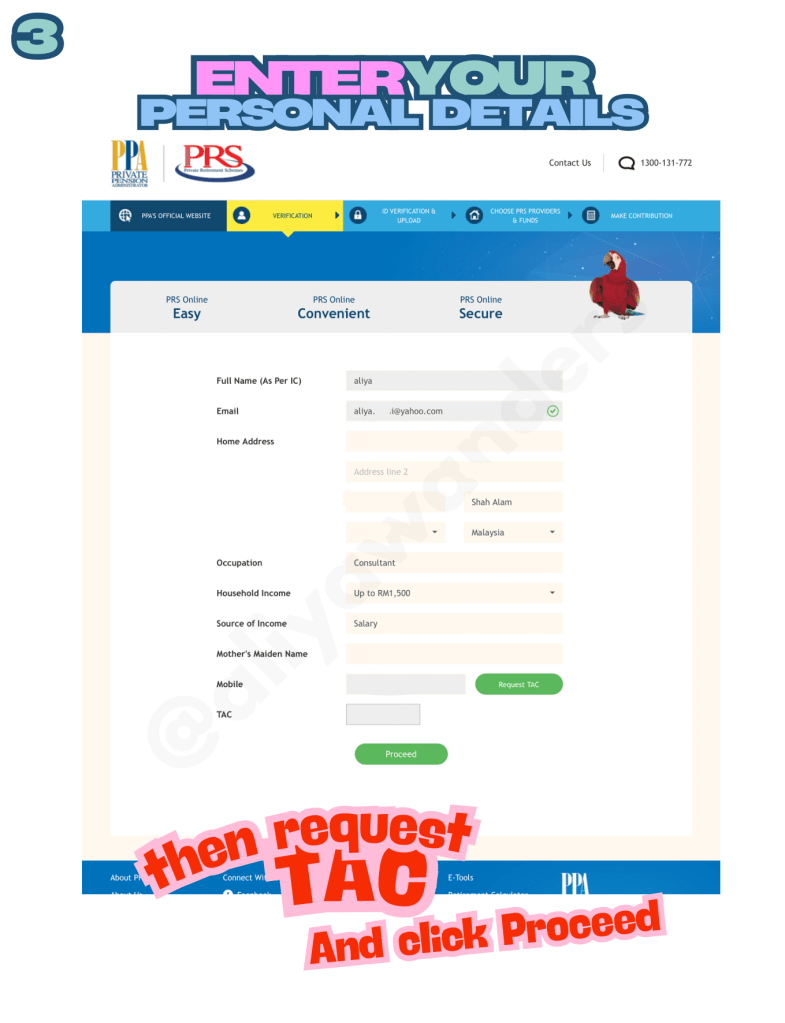

3. Once your email is verified, it’s time to enter the rest of your personal details. These details are required before you can proceed. Request and enter your TAC before clicking Proceed.

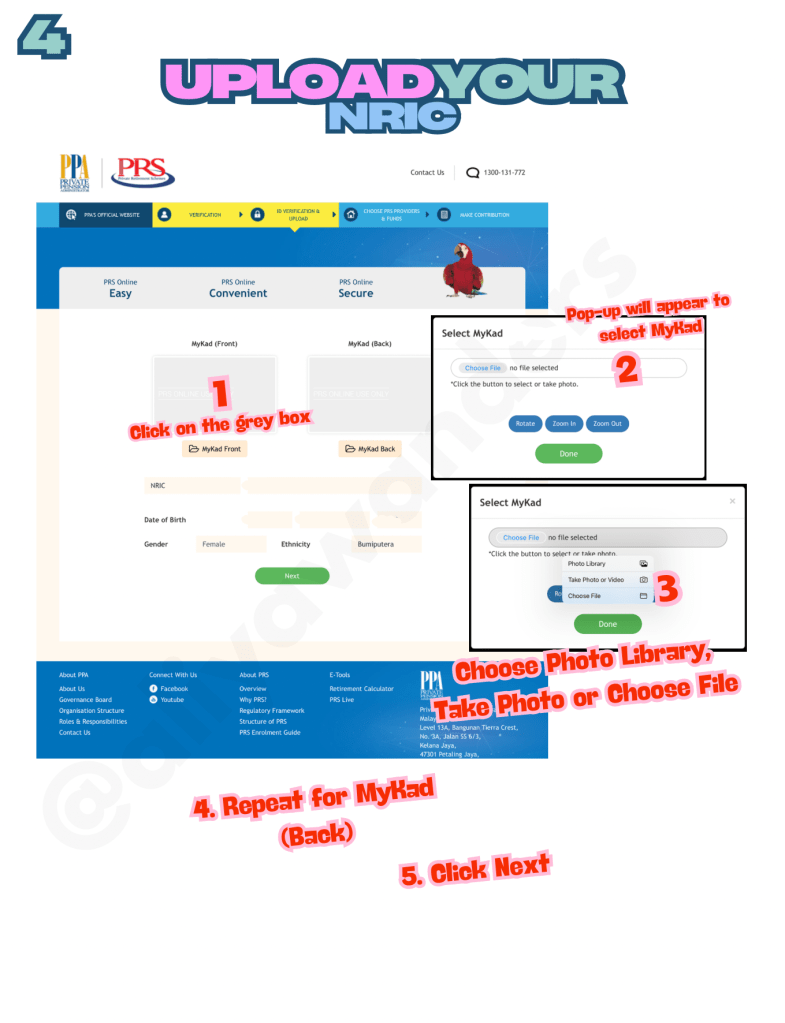

4. Next, upload your NRIC (front and back). Repeat Steps 1–3 for both sides.

There are two ways to save in PRS—you can either manually select your fund or go with the default selection. If you want to learn more about Default Selection (Do-It-For-Me) and Self Selection, check out [Part 2].

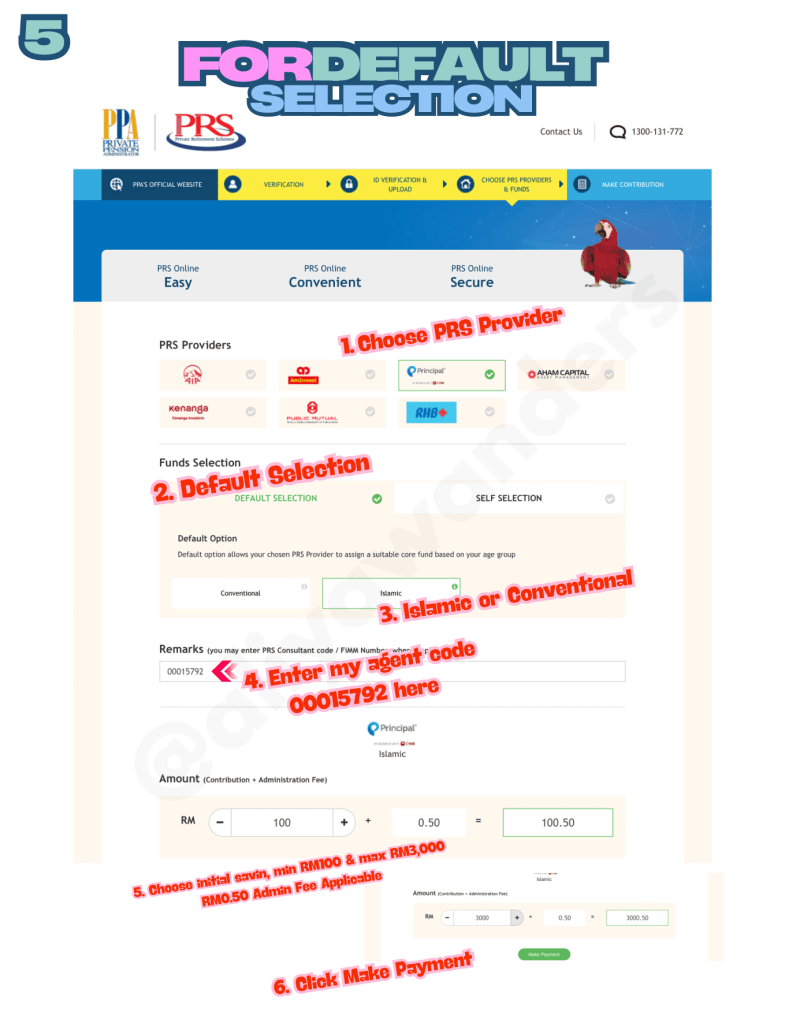

5. Tutorial for Default Selection:

1. Choose your provider.

2. Click on the Default Selection tab.

3. Choose between Islamic or Conventional funds.

4. Enter my agent code 00015792 (as shown in the photo).

5. Choose your initial savings amount (min RM100, max RM3,000). A RM0.50 admin fee applies regardless of the amount.

6. Click Make Payment.

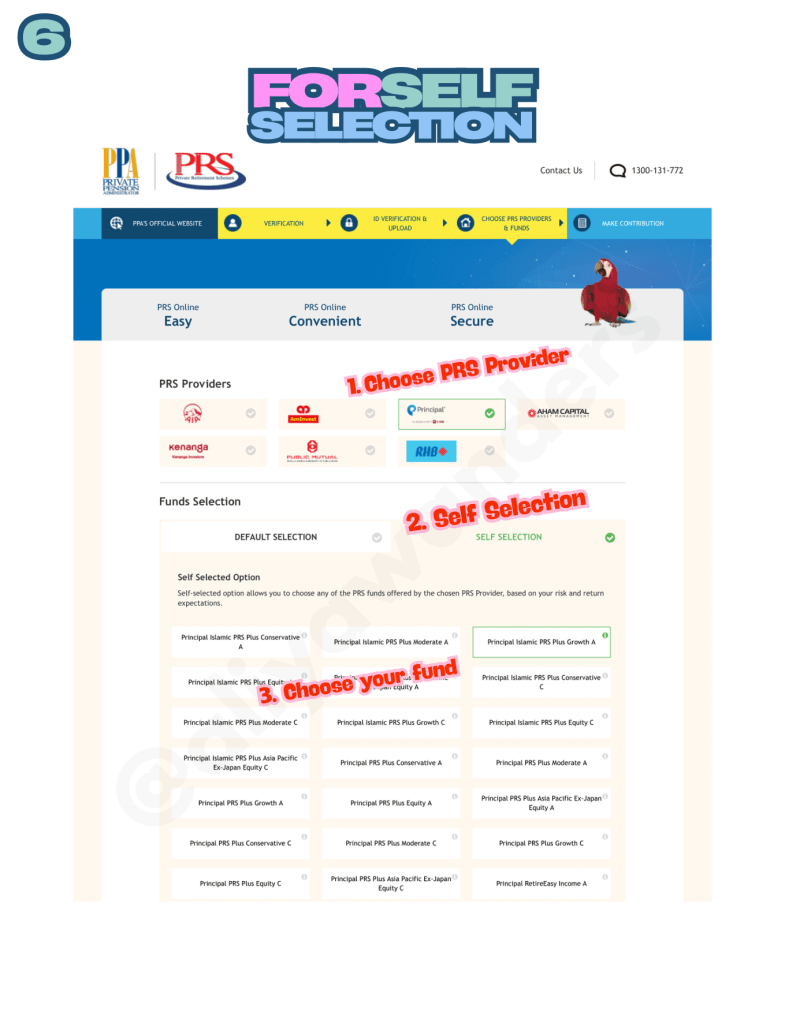

6. For Self Selection, click on the tab to view the list of funds from your chosen provider. Once you’ve selected your fund, scroll down.

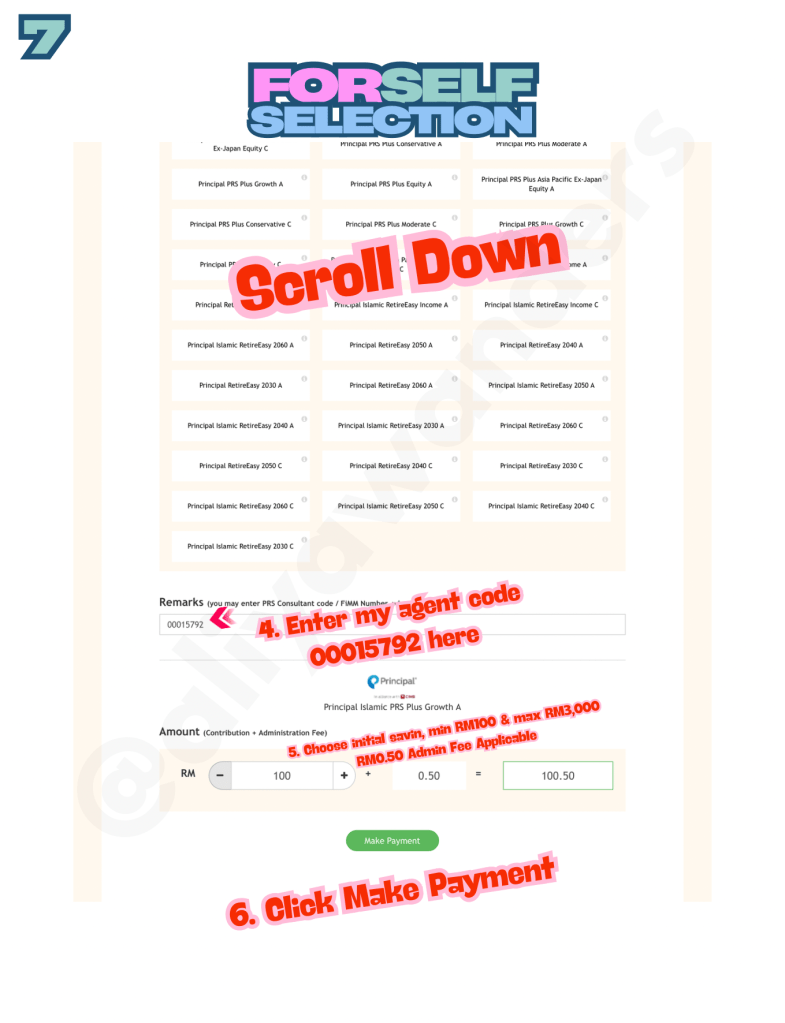

7. Next, enter my agent code 00015792 in the designated column. Then, choose your initial saving amount—just like in the Default Selection, you can select between RM100 and RM3,000. A RM0.50 admin fee applies regardless of the amount.

8. Congratulations on reaching the final step! Select your bank and click Make Payment. Before proceeding, double-check all the details, tick the confirmation box, and click Make Payment again to complete the process.

And just like that, you’re on your way to building your retirement savings!

Thank you for enjoying my articles, photos, and videos! I truly appreciate your support. To maintain the integrity of my work, please refrain from reproducing or copying my content without my written consent.

However you may share the link of any of my content. If you’d like to use something, feel free to reach out to me directly – I’m more than happy to discuss it with you. Let’s keep it professional and respectful.

Private Retirement Scheme (PRS): What’s the Deal?

This is just Part 1—stay tuned for more as the story unfolds. Don’t miss the next chapter! Click here to read Part2.

I’ve been a PRS agent since the early days back in 2012 so let me share what I’ve learned about PRS over the years—and more importantly, how it can work for you.

Have you ever thought about how much you’ll need for retirement but felt like it’s a problem for “future you”? Well, let me tell you—future you is counting on present you to make some smart moves. And guess what? The Private Retirement Scheme (PRS) might just be the lifeline your retirement savings need.

Family-Friendly Dining: Muhibbah Seafood Restaurant

Muhibbah has been around for as long as I can remember, back when I first moved to Taman Tun. A quick Google search tells me that Muhibbah Seafood has been serving since 1986. However, I only started going there regularly in my late 20s or early 30s. Let’s be honest: when I first started working, dining at restaurants wasn’t exactly affordable for me.

Salam Noodle Review

If you’re hunting for Xinjiang-style noodles in Shah Alam without emptying your wallet, let me introduce you to Salam Noodle in Seksyen 13. Self-service, no fuss, and my personal noodle haven.

Now, I’ve never been to Xinjiang (or anywhere close), but after scarfing down my fair share of mee tarik and mee hiris, Salam Noodle feels like it could maybe be the real deal. Affordable and satisfying noodles in Shah Alam? Yes, please.

Leave a reply to Huawei’s ‘Unfold the Classic’ Exhibition – Aliyawanders Cancel reply