Hi, my name is Aliya and here’s why your company should consider getting corporate medical and health benefits with me and AIA Public Takaful.

- First things first – What’s Group Insurance?

- Why consider AIA for your company’s Group Insurance needs?

- What plans are available?

- Still wondering why you should go with me & AIA?

- What else AIA Public Takaful provides (aka the HR dream team):

First things first – What’s Group Takaful?

It’s a life/medical takaful certificate that covers a group of people (usually employees). The employer (you!) is the certificate owner, and the employees are the person covered. It’s part of what we call Corporate Solutions and Employee Benefits.

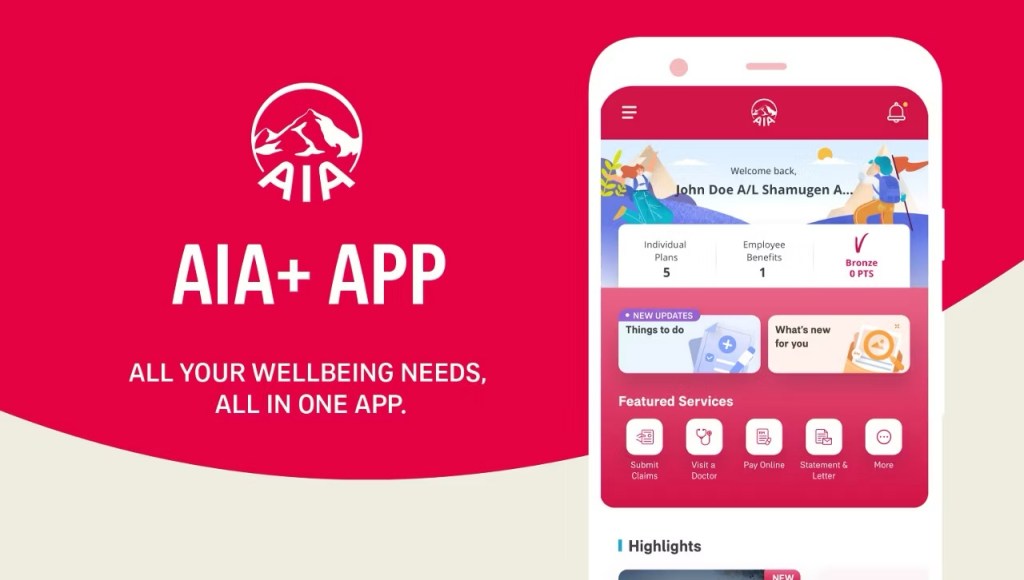

with the All-New AIA+ App

From managing your AIA takaful plans to keeping track of your fitness and health with AIA Vitality, enjoy a seamless and personalised health journey on the AIA+ app today.

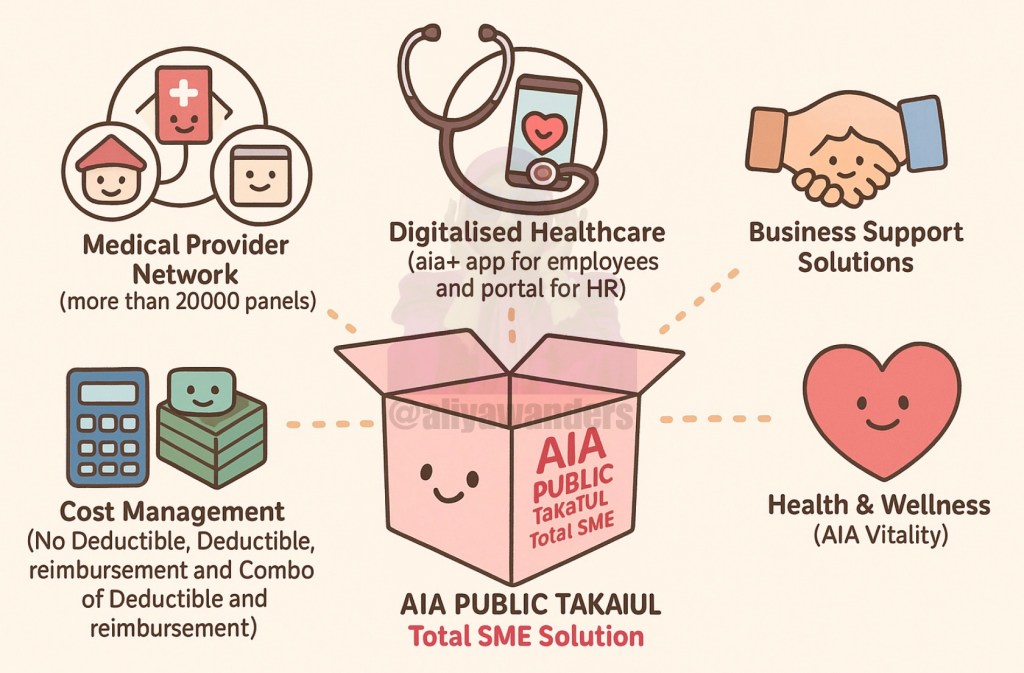

Why consider AIA Public Takaful for your company’s Group Takaful needs?

AIA offers a wide range of solutions tailored for businesses of all sizes:

1. Medical Provider Network

Access to 20,000+ panel clinics & hospitals nationwide.

2. Digitalised Healthcare

Paperless claims, eMedical cards, real-time updates via AIA+ app.

3. Business Support Solutions

HR dashboard to manage employee coverage, claims, and reports easily, anywhere and anytime.

4. Cost Management Options

Choose from non-deductible, deductible, reimbursement or combo to fit your company’s budget.

5. Health & Wellness

From Vitality rewards to personal case management (Group MedCare).

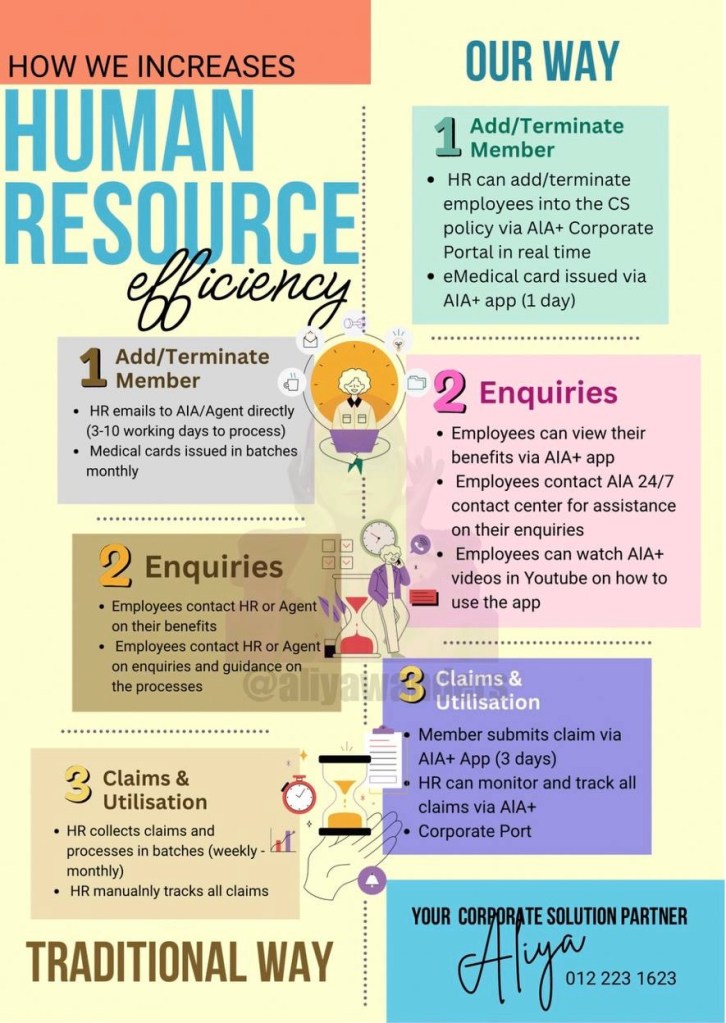

This is the go-to infographic I always share to show how we help make your work more efficient!

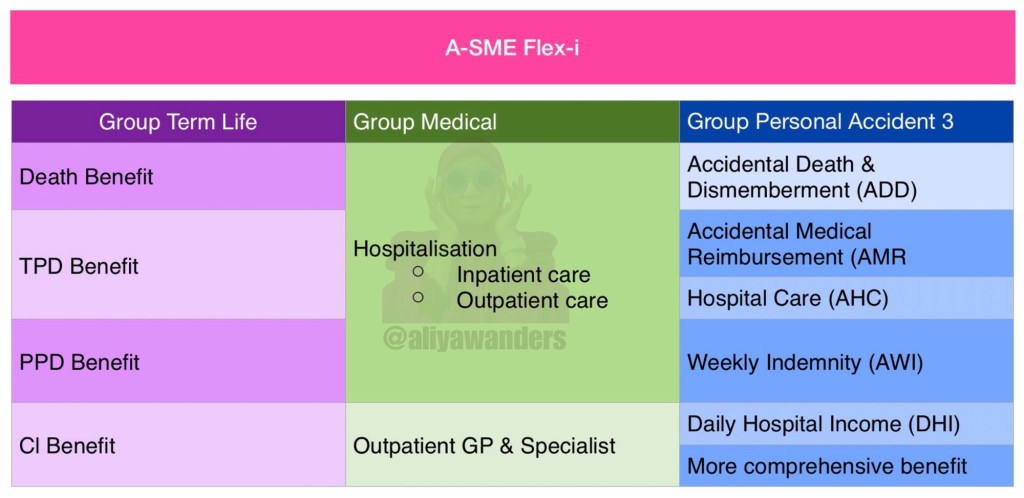

What plans are available?

1. A-SME Flex-i

For companies with 5–200 employees.

Offers:

- Group Term Life (Death, TPD, PPD, CI benefits).

- Group Medical (Hospitalisation, Inpatient, Outpatient).

- Group Personal Accident.

Note:

With A-SME Flex-i, each of the coverage comes in a pre-set coverage options — simple and straightforward.

2. Tailor-Made Plan

For 5+ employees and onwards.

Offers:

- Group Term Life

- Group Medical

- Group Personal Accident

Note:

While the coverage may appear similar to A-SME Flex-i, tailor-made plans are typically more comprehensive and often come with a higher contribution. Think of them as a personalised service – designed to fit specific needs that standard packages might not cover.

Still wondering why you should go with me & AIA?

Here’s the friendly truth:

1. Help manage rising healthcare costs.

2. Improve HR efficiency with our digital tools.

3. Boost employee satisfaction & retention.

Example: Company ABC

Has 50 employees (Age 35 with a budget of RM150 per employee/month which equals to RM90,000 annually

Wants to self-fund all three expenses : medical + accidents + hospitalisation.

That is equal to RM1,800 per employee annually.

But here’s what AIA can offer with almost the same budget :

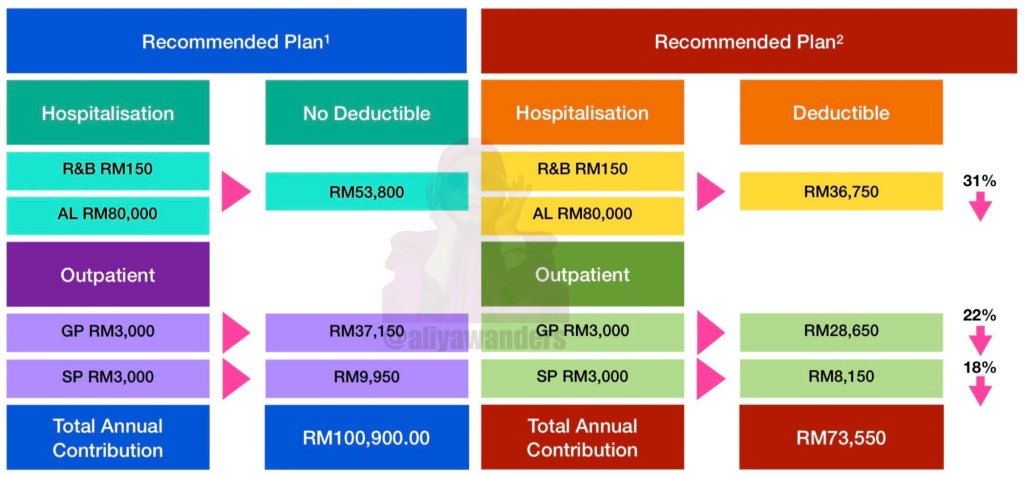

Here’s my example of Plan 1 and Plan 2: Plan 1 has no deductible, but I’ve added a deductible for Plan 2.

Recommended Plan 1 – RM100,900

Total contribution of RM100,900 or RM2,179.64 for every employee annually and with better benefit.

Here are the break down

- Hospitalisation (RM150 room & board, RM80k annual limit) – Annual contribution is RM53,800 or RM1,079/employee.

- Outpatient GP (RM3,000/year) – Annual contribution of RM37,150 or RM743/employee.

- Outpatient Specialist (RM3,000/year) – Annual contribution of RM9,950 or RM199/employee

Now here’s the best part:

Instead of just providing RM90,000 in total coverage via self-funding…

You could be offering RM4 million in total medical protection!

(That’s 50 employees × RM80,000 annual limit each = RM4,000,000 in total hospitalisation coverage alone.)

And that’s excluding the added outpatient and specialist benefits!

PLUS options to reduce cost further using deductible, reimbursement or a combo of both!

Here is an example if we were to introduce deductibles.

Recommended Plan 2 – RM73,550

The Deductibles in this table are as follow:

- Hospitalisation – RM300

- Outpatient GP – RM10

- Outpatient Specialist – RM30

A deductible means employees share part of the medical bill. It’s a helpful option to keep overall health benefit contribution more manageable.

The same coverages now cost :

- Hospitalisation (RM150 room & board, RM80k annual limit) – Annual contribution is RM36,750 or RM735/employee.

- Outpatient GP (RM3,000/year) – Annual contribution of RM28,650 or RM573/employee.

- Outpatient Specialist (RM3,000/year) – Annual contribution of RM8,150 or RM163/employee

Those are just two examples! Let’s chat and I’ll prepare a personalised quote that fits your company perfectly.

Note: All calculations shown are based on employees aged 35 years old, standard risk, excluding stamp duty and applicable government taxes.

What else AIA Public Takaful provides (aka the HR dream team):

- Benefit recommendation based on your industry & headcount.

- Customisable plans to match your employee needs & budget.

- Group Term Life – enhance employee protection.

- AIA Vitality – motivates employees to stay healthy = better productivity.

- Fast member updates – Add/remove employees via portal in real time.

- Track claims easily – All digital via AIA+ portal & app.

Ultimately:

You’re not just giving employees “takaful.”

You’re giving them peace of mind, job satisfaction, and a reason to stay.

Let’s chat more if you want to explore a plan that suits your team’s needs and your budget!

Content creator & Islamic financial planner who keeps things fun, relatable & practical. Juggling life, family & great deals—always with a smile!

And hey, if you ever want to chat about retirement savings or financial planning, just hit me up! Let’s chat! ☎️ 012 223 1623[WhatsApp link]

I’m so glad you enjoy my articles, photos, and videos! Let’s keep it respectful—please don’t copy, reproduce, or share them without my permission. If you’d like to use something, just send me a quick message. I’d be happy to chat!

Full On Kenduri Mode at APTB Raya Open House

If there’s one thing AiA Public Takaful knows how to do, it’s throw a proper jamuan!

This year’s Raya Open House was basically a full-on kenduri — we’re talking rendang, soto, satey, kambing golek, and to top it off, bottomless Tealive drinks and Inside Scoop ice cream. Lupakan je la nak diet, kita start esok je ok!

How to Submit Claim on AiA+ App – Employee Benefit edition

Got a claim to submit? No worries—let’s get this sorted in a few taps.

But before we proceed, there are two things I want to highlight…

First, got questions about your finances? I’m here to help! Feel free to call me at +60 12 223 1623 or drop a message on WhatsApp(click here). Let’s chat and navigate your financial journey together.

Want to Create a RM1 Million Legacy for Your Children?

Our children deserve a head start in life.

“Why not put aside just a portion of that money and let Takaful do the heavy lifting?”

Leave a reply to Inside Malaysia’s New Entertainment Hotspot: Idea Live Arena at 3 Damansara! – Aliyawanders Cancel reply